STOP! Before you sell your home, contact our Planned Giving team for information about avoiding unnecessary taxes.

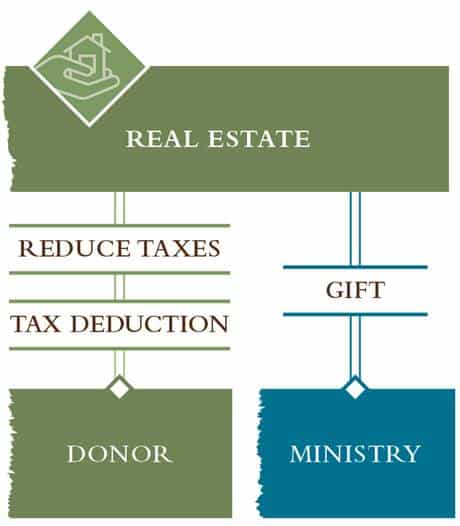

A gift of real estate such as your home, vacation property, farm or ranch land, undeveloped land or commercial property can allow you to give more than you ever imagined.

Benefits of gifts of real estate

- In most cases, avoid paying capital gains tax on the sale of the real estate

- In most cases, you receive a charitable income tax deduction for the fair market value of the gifted asset

- Help further the work and mission of Focus on the Family