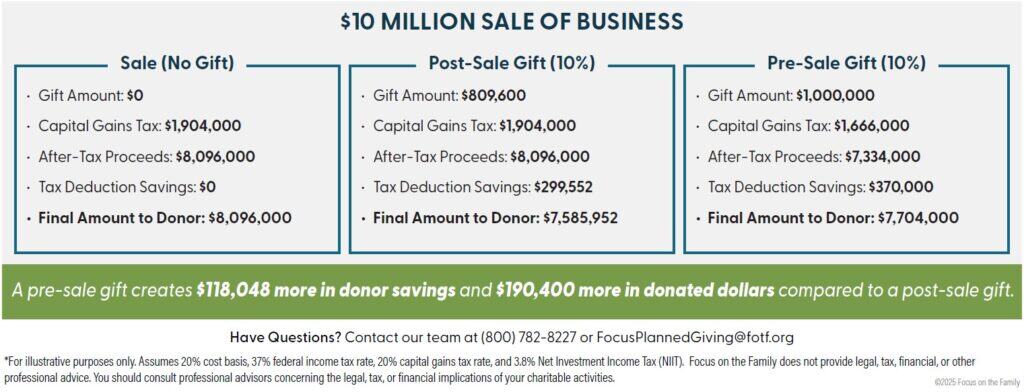

The biggest mistake you can make when selling your business is to sell first, then give a gift.

If you are considering selling your business, we can help you reduce your tax liabilities and support ministry—while still providing for your financial needs.

Benefits of a Business Gift

- Receive a charitable deduction for the asset you give to charity in the year in which you give the asset

- Avoid capital gains taxation on the portion gifted to charity when the asset sells

- Give more to charity

When a business is sold it may incur significant tax consequences. Giving a portion of your business ahead of the sale can result in a major tax benefit.

Contact us and we would be happy to assist you and answer your questions about making a gift of a business interest prior to the sale of your business.

The Power of Business Gifts Explained

See the Difference: Post-Sale vs. Pre-Sale Business Gift