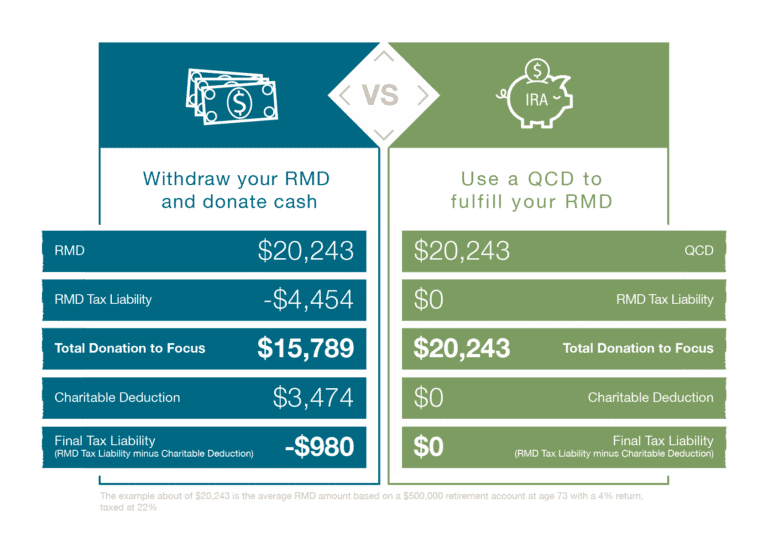

A Qualified Charitable Distribution (QCD) is the most tax-efficient gift you can make.

Donating from your IRA or another type of retirement asset to a charity can be an extremely smart tax saving plan. Funds in an IRA have never been taxed, and when you donate an asset to a qualified charity like Focus on the Family, no taxes are taken out on the back end either. This means more savings for you and allowing you to make a larger gift! Additionally, a QCD can help you avoid an increase in taxation by removing income that would otherwise hit your gross annual gross income (AGI). If you are 70½ or older an IRA charitable distribution is an excellent way to partner with Focus on the Family!

Maximize Your Tax Benefits: Give Directly from your IRA to Charity with this Smart Tool!

What are the benefits of an IRA Qualified Charitable Distribution (QCD)?

- Lower your taxable income by fulfilling all of part of your Required Minimum Distribution (RMD)

- Lower the burden of estate tax on heirs

- You can give up to $105,000 each year in QCDs, potentially reducing your future RMDs

- You transform tax dollars into ministry action to help even MORE families thrive in Christ!

What is the difference between a Required Minimum Distribution (RMD) and Qualified Charitable Distribution (QCD)?

A Required Minimum Distribution (RMD) is the portion of your IRA, SEP IRA, or SIMPLE IRA that you are legally required to withdraw yearly after you reach age 73, even if you don’t need or want the funds. These distributions become taxable income, increasing your annual gross income (AGI) and could potentially put you in a higher tax bracket, affect Medicare eligibility, or increase your Social Security income tax rate. You can withdraw more than the minimum requirement, but all funds distributed are included in your taxable income.

A Qualified Charitable Distribution (QCD), previously called the IRA Rollover, is a giving tool that allows you to send funds directly from your IRA to a qualified charity, like Focus on the Family, beginning at age 70 1/2. This distribution can fulfill all or part of your RMD in the tax year it is given and allows the withdrawal to be excluded from your taxable income. QCDs can be made to multiple charities in the same year, allowing you to leverage your IRA to fulfill all of your charitable goals. Additionally, you can send up to $105,000 in QCDs annually, and giving QCDs above your RMD can help you draw down the balance of your IRA and reduce the amount of future RMDs as well as your taxable estate. State tax on QCDs vary so if you are considering this type of gift, you should consult your tax advisor to see if this strategy is a good fit for you.

Required Minimum Distribution

RMD

- An RMD is the legally required amount to be withdrawn from your IRA annually, beginning at age 73.

- RMDs are based on IRA balance and an IRS life expectancy table.

- RMDs are included in your taxable income and increase your annual gross income (AGI).

Qualified Charitable DistributionQCD

- A QCD allows you to send funds directly from your IRA to a qualified charity

- QCDs can fulfill all or part of your RMD, eliminating the increase to your taxable income.

- Can give up to $105k per year in QCDs.

How Do I Give from My IRA?

If you are like many friends of Focus on the Family, and realize that giving from your IRA is a smart tax-saving way to steward your funds, making a QCD is easy! Just contact your IRA financial institution and request a Qualified Charitable Distribution providing them with the name and address of the charitable organization you wish to support. They will make make a check out to the organization and mail it directly to them. Here is a quick checklist for you:

- Contact your IRA administrator.

- Provide the custodian with the name and address of the charity and the amount you wish to distribute.

- Request that your name be included on the memo line or stub of the check.

- Have your IRA custodian mail the check directly to Focus on the Family Attn: Planning Giving.

- Let the charity know you are sending an IRA Charitable Distribution. You can let us know that you are giving from your IRA here.

Don’t forget these important things if you plan to donate from your IRA:

- When you file your annual taxes, use the IRS Form 1099-R to report the QCD.

- Keep track of the donation date and amount.

Other Ways to Give from my IRA?

Another way to use your IRA into a charitable gift is by leaving it to a charity as part of your estate plan. When thinking about what assets to give to family and what assets to give to charity, it’s important to understand that different assets have different tax implications. If leaving an IRA to a child, they will have only 10 years in which to withdraw the entire balance of the IRA and it all counts as taxable income, reducing the total inheritance they receive.

The worst estate planning mistake you can make is sending the wrong assets to family pushing them into a higher tax bracket or incurring large tax bills. Our Planned Giving team can help you avoid this costly mistake.

Naming Focus on the Family as the beneficiary of your IRA not only eliminates all income tax on the funds, but also amplifies the impact you make on families for Christ. Adding a charitable beneficiary to your IRA is easy. Simply complete your IRA financial institution’s beneficiary designation form to add Focus on the Family as a beneficiary of your IRA.

If you have already included Focus on the Family as the beneficiary of your IRA, let us know so we can thank you!

Give now or give later BENEFITS using your IRA

Give a QCD now from your IRA

- Fulfill your annual Required Minimum Distribution (RMD).

- Lower your taxable income.

- Make an impact on families today!

Name Focus as a Beneficiary

- Reduce the taxable burden on your heirs.

- Transform tax dollars into a lasting legacy to help families thrive in Christ for generations to come!

IRA Charitable Distribution FAQ

Q: What is an IRA Charitable Rollover Distribution?

A: An IRA Charitable Rollover Distribution is a tax-efficient way to donate money to a charitable organization directly from your Individual Retirement Account (IRA). This distribution can count towards your Required Minimum Distribution (RMD) and is not subject to income tax.

Q: Who is eligible to make an IRA Charitable Rollover Distribution?

A: Individuals who are at least 70½ years old and have an IRA are eligible to make an IRA Charitable Rollover Distribution.

Q: How much can I donate using a IRA Charitable Distribution method?

A: You can donate up to $105,000 per year, per plan owner. Thus, a married couple who both own IRAs could make a qualified charitable contribution of $210,000 in a single tax year.

Q: Can I make an IRA Charitable Rollover Distribution if I have a Roth IRA?

A: No, only traditional IRAs are eligible for an IRA Charitable Rollover Distribution.

Q: Is there a deadline to make a donation to avoid income taxes?

A: For a QCD to count for your required minimum annual IRA distribution it must be given by the same deadline as a normal distribution which is usually December 31 of the tax year.

Q: What types of charitable organizations are eligible to receive an IRA Charitable Rollover Distribution?

A: 501(c)(3) organizations, such as churches, schools, and charitable organizations like Focus on the Family are eligible to receive an IRA Charitable Rollover Distribution. Donor advised funds and private foundations are not eligible.

Q: Can a donor fund a charitable gift annuity with an IRA?

A: Yes, it is possible under the new Secure Act 2.0 in passed in 2022. There are specific qualifications such as being 70 ½ or older and a maximum dollar amount. You can read more about this Secure Act and the IRA provisions here.

Q: Do I need to report an IRA Charitable Rollover Distribution on my tax return?

A: Yes, you must report the distribution on your tax return, but it will not be taxed as income.

Q: How is the distribution made so the donor will avoid a tax penalty?

A: The best way is for a donor to authorize his or her IRA plan and the administrator to make the distribution payable directly to the charity. Accordingly, it’s important that the plan administrator provides the charity with information about both the donor and the charitable gift so that the charity can present the donor with a letter of acknowledgement. Without this documentation, the exclusion is not available.

The general information contained in this article is not intended as a substitute for professional financial planning or tax advice. We strongly recommend you discuss your circumstances with your tax or financial professional. If you wish to discuss the IRA charitable distribution at greater length, or if you wish to inquire about other strategic giving opportunities, please call Focus on the Family’s Gift & Estate Planning team at 800-782-8227.