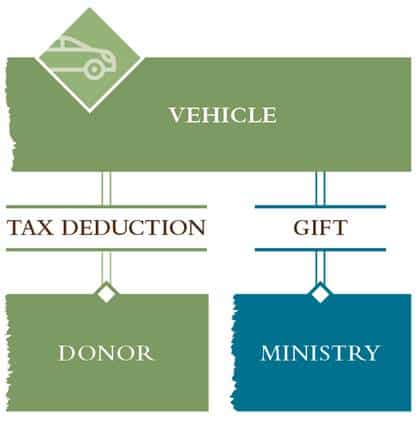

Focus on the Family can benefit from gifts of cars, boats and recreational vehicles.

The process is simple and convenient.

Benefits of Donating a Vehicle

- You may receive an income tax deduction

- Proceeds from the sale of your vehicle will help further the work and mission of Focus on the Family

How to Make a Vehicle Donation

Focus on the Family has benefited from vehicle donations by working with an organization specializing in this area, Vehicles for Charity (VFC). VFC is a national organization that is able to accept donations on behalf of Focus on the Family. The process is both simple and convenient. In most cases, VFC is able to pick up your car, truck, motorcycle, boat, or RV/motor home from locations throughout the United States. By donating through VFC, you are able to support Focus on the Family and receive an income tax deduction. For your convenience, the following link will direct you to the “Donate Your Vehicle to Focus on the Family” form: http://www.vehiclesforcharity.org/charities/

If you file an itemized tax return, you are allowed to deduct the amount of the gross sale proceeds from the sale of the vehicle at auction or sold outright by the charity. For more information regarding the valuation of your donation please contact Vehicles For Charity toll free at 866-628-2277 or visit their website at www.vehiclesforcharity.org