Opening:

Teaser:

Mrs. Julie Crosson: When he asked me to marry him, I said no, because I’m not gonna be poor. You’re a teacher, and I’m not gonna choose that. Why would I choose that?

End of Teaser

John Fuller: Russ and Julie Crosson were our guests last time on “Focus on the Family,” sharing very personally about friction in their relationship, and how they got to a “yes” in regards to marriage. And they’re on our broadcast again today, as we talk about getting on the same page financially with your spouse. Your host is Focus president, Jim Daly. Thanks for listening. I’m John Fuller.

Jim Daly: John, you know, it’s so encouraging to see Russ and Julie Crosson, who came from a similar perspective and they had similar likes, but they were different in some of their makeup, the gifts that God had given them. Russ is more of an accountant type, you know, a money guy. He understands money. He was a teacher and a coach, which I love. A coach led me to the Lord, so I have a heart for Russ already.

And then Julie, man was that refreshing! And if you didn’t hear the broadcast last time, you need to get it. You can download it; download the app for your smartphone. That’s a good way to listen to “Focus on the Family.”

But Julie really uncorked her emotions as a young woman and what she was feeling with the idea of submission and she wanted to marry a guy who was a little wealthier than Russ was and had a bit more in the pocket and that was a big discussion that she had with God. And today we’re gonna concentrate on when they got married and how they began to tackle their money issues.

John: And Russ is the president and CEO of Ronald Blue and Company and he and Julie speak about money and marriage and communication and they mentor a lot of couples and it really is a dramatic story. I’m glad they’re back.

Body:

Jim: Ah, Russ and Julie, welcome back.

Julie: Thank you. It’s good to be here.

Russ Crosson: Jim, thanks for havin’ us back.

Jim: Okay, man, it was a wild ride on that last program.

Russ: I’m surprised you had us back after that. (Laughter)

Jim: But it was good. We didn’t talk much about money. We talked about God’s design in marriage, God’s design as man and woman, and I thought it was outstanding, so thank you for that. But today we do want to turn more specifically to the content of the book, 8 Important Money Decisions for Every Couple. When you look at it, why is money such a big issue in marriage?

Russ: Well, Jim, the reason it is, is ’cause we all have to deal with it, right? We gotta put braces on the kids. We gotta buy groceries. We gotta pay car insurance and so forth, so, you have to deal with it. It’s utilitarian and so, right off, when you get married, money’s right there. You have to deal with it. But the issue is, it brings out these differences. You may have a different background. Maybe you come from a family which didn’t like debt. Maybe the other spouse came from a family that used debt. It was no problem having credit cards. Then you’re just different as male and female. There [are] some differences that money will bring out. We may get into that, but you know, typically, one spouse may be more security-oriented, the other, more risk-taking. One may be more long-term, more short-term.

And then you have different personalities. You know, somebody, you know, is a sanguine person. He [or she], male or female, they may never know what a checkbook even is. And the melancholy’s like, you know, let’s keep track of everything. So, money is a catalyst to bring out some of those differences and when I started, I thought I was a financial advisor, but I realized that I was more of a marriage counselor to a degree, ’cause money brought out some of these differences.

Jim: Well, and that’s interesting. That’s the right observation, because money does put the highlight, or it puts pressure on the fractures that are already existing in the marriage. Is that a fair way to say it?

Russ: That’s a fair way, you know. It’s not really about the money; it’s about [the fact that] it exposes these differences—

Jim: Huh.

Russ: –that we bring in and so, you get married and you’re in love and all of the bliss, but then you get down to, okay, who’s gonna pay that bill? And oh, gosh, how are we gonna deal with this? And so, money just brings out the differences, which you have to learn to work through.

Jim: You mentioned early last time, and I want to press into this right now, you were very different in your money approach. Julie was never balancing her checkbook. She had enough in there. She, I’m sure called the bank to say, “How much in in there?” Is that fair?”

Julie: No. (Laughter)

Jim: You didn’t even call the bank.

John: She didn’t ask.

Julie: No. I wouldn’t even call the bank. (Laughter)

Russ: She just knew there was enough in there.

Jim: Okay and then, Russ, you were like scrutinizing every penny. You got married and every night you’re askin’ her, “How much did you spend today, ’cause I’m only makin’ $9,000 as a teacher and a coach and I got extra jobs in the summer, but man, did you buy bread today?” (Laughing) I mean, so where was that first real flash point for you? Describe that night or that moment when you guys went, “Uh-oh.”

Russ: Well, I realized that, that was causing her to feel like I didn’t trust her, and I did trust her.

Jim: Really, did you really?

Russ: I really did, because I knew from her background and other things, that even though she didn’t balance it and all that, I knew she knew there was enough in there. And so, we realized though that we’d better come up with a plan and a system and that’s the motivation. As Julie said last time, she didn’t like the B word, so we called it “Planned Spending.” But I think what I could encourage folks with is, the reason you do that, it’s just a motivation for doin’ the budget is the key and we needed to do somethin’.

Jim: It’s a plan.

Russ: It’s a plan, not an issue. You’ve gotta do whatever it takes—

Jim: Huh.

Russ: –and we’ve learned some tricks. We share ’em in the book. You know, every system ends up being an envelope system, and different things like that. But the point is, the motivation for why you do it, “why” is a small three-letter word, but it’s the cause, reason or purpose for something. Well, the cause, reason or purpose for doing a budget, for having a spending plan, is ’cause my marriage is worth it. Why let money, which is temporal, be a source of conflict? So, we learned pretty quick, you know, first few months in, that we better come up with how we’re gonna do this.

Jim: Julie, let me ask you, were you a big spender? I mean, you knew you had money in the bank. You didn’t reconcile your bank account, but were you a big spender?

Julie: No, I wasn’t a big spender, ’cause my family didn’t like debt. So, I have always paid off the credit card and we paid cash for everything. So, I saved up. Anything that I wanted, I paid cash for it.

Jim: Okay.

Julie: So, I wasn’t a big spender, but on the other hand, I didn’t sit on it either. I tried to save some every month, but I didn’t mind spending it either.

Jim: Hm.

Russ: So, anyway, I think the biggest thing, Jim, is that when you get married, money’s gonna bring out these differences–personality differences, male female differences, your different backgrounds. And so, then how are you as a couple gonna work together? Because here’s the end game; you don’t want to be talkin’ about money all the time.

Jim: Right.

Russ: You want to make it a non-issue as best you can.

John: Well, was there a particular money conversation that really just turned the light bulb for you all? I mean, Julie, do you remember a moment where you just felt like, “This is just not worth it?”

Julie: Well, that time we were livin’ in an apartment in Atlanta and he was makin’ less than when we first got married. And he came in (Laughter). He probably came home for the fourth or fifth time and asked me what I was spending. And it was like, this isn’t working. We’re gonna have to do something.

But I had been pushin’ back on the budget, didn’t really want to do a budget. But once we realized we’re gonna have to have a plan and so, when we sat down to come up with the categories, and then, we decided we needed to agree on what was in each category, because he thought we could get by with $100 a month for groceries.

Russ: And she said, “Yeah, we can if we, you know, eat beans.”

Julie: So, I’m like, that’s not working. I buy the groceries; we can’t do it on that. So, if you want to eat beans, that’s fine. But on the other hand, we’re gonna have to figure it out. So once we put our heads together, agreed on the categories, what I found out was, I enjoyed the budget, which I can’t believe I’m saying, because (Laughter) what happened—

Jim: Well, it’s a testimony.

Julie: –was that because I had a standard, I wasn’t responsible for the whole thing, now that I had a limit and everything’s an envelope system. So, I had an envelope, but we did it in my checkbook. So, I had a certain amount for groceries. I don’t remember what it was, but I had a number in my groceries category.

And then when I would write a check or put it on the debit card or whatever, I would subtract. So, I know where I am through the month on groceries or allowance or children or whatever. And so, what it did was, it gave me control. So, I know where I am, so that I felt good about what I felt I was contributing.

Jim: So, you were making progress, ’cause before you really didn’t know where you were at.

Julie: And I didn’t want to. Now it really helped me to know where I was, because what I felt like, I was helpin’ Russ not to worry, because he and I could both look in the checkbook and know where I was. He knew that he wasn’t gonna get a big surprise at the end of the month.

Jim: Hm.

Julie: And so, he could relax, knowin’ that I’m gonna stick to this. If it got to the point where it was tight, like the last week of the month, I’d say, “Okay, I got $20 left. I really need to go to the grocery store, but we can just make it. You tell me what you want me to do.” And he would say, “Well, I haven’t spent as much in this category, I can give you a little from mine.” Or “We just gonna just have to keep it tight and make it.”

So, it ended up being fun for me. It ended up bein’ a game to see how well I could do each month, which is kinda my personality. But I loved the challenge of seein’ how well I can do with my category that I had agreed on.

Jim: Something you hated before.

Julie: Yeah.

Jim: That’s really—

Julie: And now—

Jim: –good.

Julie: –it got to be fun.

Jim: Hey, Russ, let me ask you, in your years of counseling and married couples predominantly, what are some basic problems that stand out for you? What are the consistent things, the big bucket issues that they come in with in this area of finances?

Russ: Oh, gosh, Jim, that’s a great question. I think a few things. First of all, when you ask people what they make, they give you the net income, not their gross income. So, they forget that all that stuff that’s being withheld is really their money, too—you know, taxes, 401(k), medical.

So, what we see is, it’s they don’t really have a good understanding of the overall plan, and what goes in all the different boxes. There [are] only five things you can do with money. You can spend it; you can give it’ you can pay taxes; you can pay debt or you can save it. And so, one of the first mistakes is, they don’t really understand what goes in all those boxes.

Jim: Hm.

Russ: We see young couples many times in too big of a hurry to retire. They’re funding retirement and not putting money in an emergency fund. And it’s great to tell your wife, “Hey, honey, I’ve got 50,000 in a 401(k),” and she goes, “Great, I can’t buy kids’ braces with that.”

And so, we see many times that they get the retirement cart out ahead of the horse, instead of, you know, doin’ some things that helps them.

Jim: That’s kinda contrary to a lot of—

Russ: It—

Jim: –money managers.

Russ: –really is. But I’ll tell you, Jim, if I just say anything to couples, don’t be in a hurry to retire. Get some cement in the basement. Get some money in the bank account. Have that emergency fund. It’ll take stress off your marriage, because you know, it’s great to think about retirement, and plan for it, but not at the expense of livin’ life and havin’ money and no budget system. And we just talked about budget systems. No budget system works without some cash.

Jim: Right.

Russ: And so, I’d say, you know, don’t hurry to quit or hurry to retire. I think another thing that we see is, that people don’t do investments sequentially.

Jim: What does that mean?

Russ: Well, sequential investing means, you do certain things first. Most people think they get a little bit of money, I gotta go “invest,” ’cause that’s how I’m gonna make a lot of money. I’m gonna get financially secure. But sequential investing is, you pay off the credit card debit first. You save three to six months living expenses. You try to put 20 percent down on a house. You save for major purchases. We were talkin’ about washers and dryers and dishwashers earlier.

You save for those things and people say, “Well, that’s not really investing.” Well, guess what? If you don’t do that, you’re gonna be payin’ these exorbitant credit card interest on things like that. So, I think– and we talk about this in the book–if couples would just invest sequentially. Go slow. Don’t be in a hurry to retire. Don’t be in a hurry to invest, it’ll get ’em off on the right foot.

And so, as I think about couples, that’d be what I would say. And then one last thing I’d say about the budget. The other thing we’ve seen with young couples, a big “ah-ha,” is when they actually do a budget, they don’t distinguish between monthly items and non-monthly items. You say, well, what do I mean by that? Well, most people will set their budget and they’ll budget monthly items. They’ll budget for gifts and vacation and clothes and auto repair and things like that, a hundred a month. Well, these are typically non-monthly items. Hopefully, your car’s not breakin’ down every month.

Jim: (Chuckling) Right, but they should do that in order to get the $600 repair done at the six-month mark?

Russ: Well, but if it doesn’t break down in six months, Jim, that’s why it doesn’t work. So, here’s—

Jim: What if it’s an $800 repair bill?

Russ: Well (Laughter), so here’s what I mean by that and we talk about this in the book and I would encourage you to look at this chapter on this, because we found that couples will say to us, “I finally can make a budget work because I finally understand how to do this budgeting between monthly and non-monthly.

So, most people set a budget and do a New Year’s resolution, right? They’re gonna do a budget. Well, they stop in February, and here’s why. You know, they budgeted a 100 a month for clothes and 100 a month for medical, 100 a month for vacation. And then January comes along and the car breaks down and they find a good sale, and they want to get away for Valentine’s weekend and it doesn’t work, ’cause you need to have more money in there.

So, you said what are some of the key things that we see with couples, it’s learning how to do a budget that actually works. And one of the key trigger points is this little distinction here and then remembering that every budget is an envelope system.

Here’s another thing I would say to us. I ask people, “Are you on a budget?” “Yeah, I can tell you how much I spent.” Well, if you can’t tell me how much you have left to spend, you’re really not on a budget. You’re just …

Jim: So that’s the definition of a budget.

Russ: A budget is, okay, so if you ask me today, “Hey, Russ, it’s May 27th, how much do you have left in vacation?” I can tell you. “How much do you have left in auto repair?” See, ’cause I’m working against a predetermined budgeted amount.

Jim: Yeah.

Russ: You don’t want to know how much I’ve spent. That’s not really a budget.

Jim: But let me roll you back to January or February, like you said. So, you had, you know, a couple of months and you hit all these expenses. How do you recalibrate at that point, so you don’t toss the budget and just start going into debt?

Russ: What you do is, you put all those non-monthly items in one big envelope called “Non-Monthly.” So, for example, like you said, I’m budgeting for the auto repair. I may have a $1,200 annual budget, $1,200 for clothes, let’s say. Well, if I want to spend $300 on each of those in January, I’m still on budget, right? I still have 900 left—

Jim: Right.

Russ: –in each of ’em.

Jim: You just—

Russ: I’m just–

Jim: –can’t spend 300 a month.

Russ: –I just can’t spend 300 a month. And so, the idea is, you have one big envelope with the non-monthly items, but this is why, Jim, it’s so important to have some cash to prime the pump. You cannot make any budget work paycheck to paycheck. You have to have some cash to prime the pump to get started. Because see, you’ve gotta have several hundred dollars in that annual envelope or that non-monthly envelope in January 1st, so you’re available to pay it in January.

Jim: I hear that, Russ, but I also read the news report where 70 percent, maybe higher, of households in America are living on a paycheck to paycheck basis. So, if you’re in that spot, how do you begin to accumulate a nest, so you can run a budget?

Russ: Well, so here’s what we’ve learned. Where that extra money is, is usually in taxed-over withholdings. People get a refund usually. That’s really their money they’ve let the government have and then they go on a trip, have a great vacation in April or May when they get their refund. So, I would really go look at your tax withholdings, because, there’s probably extra money there that you could use to prime the pump.

Jim: So, start your budget when you get the return.

Russ: Yeah, right, that’d be a great time to start it. Just stick that in that annual envelope, ’cause most people get a refund and then they think it’s a windfall, and they go blow it.

Program Note:

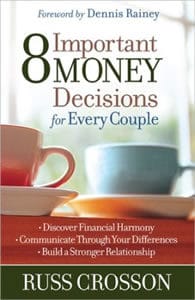

John: Well, some great insights today from Russ and Julie Crosson and this is “Focus on the Family” with Jim Daly. I’m John Fuller. We’re enjoying a great conversation about a very tough subject for a lot of couples. This is somethin’ that can be a real wedge issue for relationships as you’ve heard throughout this past couple of days. And the book that Russ has written from his heart to help you is called 8 Important Money Decisions for Every Couple. And the three bullets underneath, Discover Financial Harmony, Communicate Through Your Differencesand Build A Stronger Relationship. I think you’ve caught some of that right now. Get the book though. It has a lot of detail in it and we’ve got it at www.focusonthefamily.com/radio.

End of Program Note

John: As you’re talking, I’m just wondering, ’cause I’d love to hear Julie’s take on this. It feels like a lot of couples are gonna be tempted to say, “This is the budget. You’re not stickin’ to it.” There has to be some give and this took time, didn’t it?

Russ: Yeah, you have to always allow 12 to 18 months. It does take time. There has to be give and take and you have to be talkin’ about it. But you asked earlier, how does the money thing create marriage harmony? Well, it forces you to have to come together to talk about somethin’ and you just have to practice doin’ it. It did take months. Maybe, like I said, a year, a year and a half to really get on the same page on this.

John: And was that you, Julie, moving toward Russ? Or the both of you moving toward each other?

Julie: Well, probably both moving towards each other, because I was kinda frustrated, ’cause I thought it should work out right away. In reality It did take 12 to 18 months to get the numbers right, and he would keep sayin’, “I think it’s gonna take us a while to get the numbers figured out.” So, then I’d kinda relax on that, realizing I didn’t have to do it perfect[ly] from the very, very beginning.

But, one of the things that I had to do because I didn’t trust myself, because I had this feminist mind-set that I was comin’ out of, in Romans it says to renew your mind according to His Words. One of the things that we’ve seen and I saw in my own heart is that money’s not really the problem. Money is named as the problem and in fact, it’s named in divorces, that the money was why we divorced. But in reality, money surfaces heart issues. So, when I started, actually my parents were good friends with Dr. Henry Brandt and his thing was, to “guard your heart with all diligence, for from it flows the issues of life.”

So, when the money issues surface something, it doesn’t do any good to try and communicate and fight back and forth, because there’s a sin issue goin’ on. I want my own way, or I didn’t like something, or I felt like I should be heard first, or he should do what I want to do first.

So, what I found was, that when money does surface these issues, Russ isn’t making me mad. He’s revealing a heart that’s angry, that wants its own way. So, the first I’ve got to do is ask the Lord to forgive me for wanting my own way, for demanding and for bein’ angry. And then ask Him to cleanse my heart. And then what I found is, then I can go to Russ and talk things through in a way that we can come up with answers.

Jim: That’s not defensive.

Julie: Yes.

Jim: Yeah, ’cause I think that’s the typical marriage argument is right there. Everybody gets defensive. Either one challenges the other for that expense and then it’s, “Well, who are you to tell me? I mean, I make money for the family, too,” or whatever the argument—

Julie: Right.

Jim: –might be.

Julie: Right.

Jim: And then it’s off to the races.

Russ: Well, Julie mentioned earlier that you start, Jim, with this assigned responsibility. You just have to sit down, and the key to budgeting is, don’t leave categories unaccounted for. That’s the first kinda key point. Some people just leave stuff out. In my budget works, I just left out car repair. I just leave (Laughter) out, you know, house repair. No, get everything accounted for. Be realistic on your numbers and then talk about ’em. This is why it takes some time.

But at the end of the day, you know, you have to have enough money comin’ in to take care of your family. And I’ve been doin’ this 35 years. I[‘ve] never seen anybody not have enough to meet their needs. So, I think if you can make it hard on yourself early on and take the time to communicate and live on a budget, it’ll get easier for you later.

Jim: Russ, let me ask you this. With all of that counseling that you’ve done, give us one of the worst-case scenarios. Obviously, don’t use their name to protect them, but what was one of those things where there was all this debt, no budget and they actually were able to work out of it? I think I’m asking you for hope.

Russ: Yeah, what I would say to you, Jim is, there’s always hope. Julie and I just met with a couple just recently and it’s a very difficult situation, a second marriage for both and as Julie said, they’re both lookin’ at each other to make each other happy.

But when we cut through it, they think it’s a money issue. So, I got an e-mail that said, “Hey, we want you to help us set up our budget.” I said, “Wait a minute. (Laughter) Until you communicate to me that you’re committed to your marriage to do whatever it takes, then we’ll get to the money stuff.”

So, we met with them and the nice thing is, they have some stuff to work with, you know, pretty good income. But you know, they’re makin’ some decisions, private school for the kids, and money put in the retirement plan. And they live in too big of a house. And so, we’re just in this process, but what we’re very hopeful they’ll do, is decide, “Hey, our marriage is so worth it that we’re gonna take the medicine.” And the medicine in this case is, take the kids out of private school, downsize the house and take $50,000 out of their retirement plan, pay the penalty. I said–

Jim: Pay the penalty?

Russ: –“We’ll look at that as an investment in your marriage. You’re paying 250 a month for counseling right now anyway, so it’s not gonna take much longer before you’ll eat that up anyway.” But the point is, the hope is that if you’ll just be committed as a couple to take the next right step and there are some right steps; there are some solutions in there, but you gotta be lookin’ to God and not to each other.

The biggest ah-ha for this couple is, is that they’ve been lookin’ to each other. You know, if you’d just make more money or if you wouldn’t do this or if you wouldn’t just [have] done that and that’s not the issue. They need to be sayin’, “Okay, we’re gonna come together.”

It’s kinda like playin’ tennis, you know. You quit playin’ singles and start playin’ doubles. And instead, in many of these relationships, couples are using their rackets to beat on each other. You need to get on the same side of the net and be teammates on this.

And the way I’ve seen happen that helps couples is when you show ’em the longer term picture. You know, hey, your kids really don’t care where you live. You care. You know, your kids care that, you know, you’re keepin’ your marriage together. So, you have to kind of paint a picture for ’em, that the reason it’s worth dealin’ with the money, which seems so sticky and messy, is because my marriage is so much more important and [that] the posterity I’m leaving, and the generation that I’m gonna impact hang in the balance.

Jim: Russ and Julie, let me ask you this question. It was kinda interesting. I came back from a trip. I visited a Fortune 500 president and he was talking to me about how they have to retrain college grads today. And it was fascinating. He said, “You know, we get ’em into the company at about 21. They’ve been so doted on. They’ve been told all their life, they’re excellent. They’ve earned trophies for coming in last place.

Julie: (Chuckling)

Russ: Right.

Jim: I mean, it’s that typical thing. (Laughter) And they employ over 100,000 people. And he said we have a re-engineering program that we have to put these people through H.R. and it’s a boot camp. We have to break them down about how good they are; get ’em back to reality.

And I’m thinkin’, man, businesses have to do that because parents have not done the job. Do you encounter that, the 20-somethings that are going—

Russ: Oh.

Jim: –“I just spend because, you know, somebody’s gonna bless me with a big gift, ’cause I’m wonderful.”

Russ: Yeah, I’m wonderful. When do I get the corner office? You mean, I actually have to show up on time, and I actually have to perform? So, you’re exactly right, and so, the biggest thing we’ve learned is, that parents are modeling for their kids. So, if you model for your kids, struggling on a budget, they’re gonna learn a lot, that hey, when they get out, there’s no, you know, unlimited resources for unlimited alternatives. So, I’m gonna have to have trade-offs.

And so, part of the reason you want to fight through this money thing as a couple is your kids are watching. They’re not gonna miss anything. As our boys have gotten older and I asked the boys, I said, “Hey, what would you tell people were some of the great things we did?” And I thought maybe they’d say, “Well, family devotions,” or [something like that]–

Jim: (Laughing) Yeah, that’s what you’re always pullin’ for.

Julie: You’re hoping. (Laughter)

Russ: –the coming of age, you know, the raising a modern-day knight, you know, the whole age 13, you know, transition period. And they said, “No, dad, you and mom modeled it. We were watching.” ‘Cause even when we thought they weren’t listenin’ at all, they weren’t missin’ a thing. So–

Jim: Right.

Russ: –so, part of this financial piece is, you struggle through it as a couple, because your kids are watchin,’ and then they’ll be much more equipped, when they go off to college and get a job.

Julie: I would say, too, one of the interesting things, our boys, when they got to high school, they had to work for their money. So, they actually had a lawn service, that they wanted to play paint ball, which is what they did. And if they wanted a car, that we would match them for the “Hope Scholarship,” but they would have to come up with some of the money. So, they had to work and so, they were drivin’. We got a school car, which was a very old car that could hardly go over 35 miles an hour, which was a benefit–

John: Ideal for a young boy driver.

Julie: –in itself, yes.

Jim: The “school car,” I like that.

Julie: So, then they have –

Jim: Do you hear that, Trent and—

Julie: –then they had—

Jim: –Troy?

Julie: –to work for their cars. And so, they later came back and thanked us that they were drivin’ those old cars when their friends were drivin’ the BMW’s and the Mustangs. They said, “You know what? Thanks for not givin’ us all that stuff, because we feel really good about ourselves, that we’ve had to work hard for this, and so, it makes us appreciate it.”

Jim: That’s a good word.

Russ: Yeah.

Julie: So, you want to say, they’re stupid till they’re about 20, 21.

Jim: Ooh, okay, that’s a good word, too.

Julie: Yeah, so (Laughter)–<