John Fuller: Well, I’m John Fuller. And on today’s episode of Focus on the Family with Jim Daly, we’re gonna explore how your money can impact your marriage.

Husband: Well, it’s true. Uh, we’re in a bit of a financial fix, but we’ve been this way for a long time.

Wife: Well, we wouldn’t have these problems if you would just make more money-

Husband: More money.

Wife: … or get a second job.

Husband: Second job. You know, it really doesn’t matter how much I make-

Wife: Yeah.

Husband: … you’d find a way to spend it all anyway.

Wife: Oh, oh, oh, so it’s my fault, is it?

Husband: Yes.

Wife: Well, what about that new stereo you purchased last month-

Husband: Oh, the new stereo.

Wife: … without telling me?

Husband: I told you that was for my office.

Wife: Oh, the office. Yeah. Uh-huh.

Husband: Yeah. But you’re always-

Wife: Yeah, I’ve heard that one before.

Husband: … buying more clothes-

Wife: Yeah.

Husband: … shoes, and makeup-

Wife: Well, computer parts, hello-

Husband: … than any woman would ever need.

Wife: … tools. Uh, excuse me.

Husband: I mean, come on.

Wife: Yeah, really?

Husband: Look at those shoes that you got on now.

Jim Daly: John, that sounds pretty intense, right?

John: Yeah, it does.

Jim: (laughs)

John: Yes, wow.

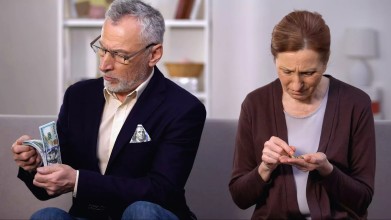

Jim: Hopefully, we’re not living in that space, but maybe some are. And money can be a touchy subject for husbands and wives. It always ranks as number one or number two of marital conflict. And today, we wanna talk about that. Uh, most, if not all, of the decisions we make usually involve money. Purchase this. Don’t purchase that. Maybe, like, a car or maybe, like, just a vacation or something else you got to do as a couple, money is involved.

John: Yeah. It’s a part of our everyday lives. We got to get a handle on it.

Jim: Yeah. And, you know, there’s a reason why, I think, most couples in their wedding vows say, “For richer or for poorer.” That means something. And, uh, today, again, we wanna equip you to be able to manage your money in such a way that it reduces… It may not eliminate, but it will reduce conflict in your marriage.

John: Yeah. And Taylor and Megan Kovar are here. Yeah, they’re authors, speakers, and financial planners who have a passion to help couples and families achieve financial freedom and, uh, a peaceful home, which is a good goal-

Jim: (laughs)

John: … and also a thriving marriage. And, uh, Taylor and Megan are known as the money couple. They’ve written a book called The 5 Money Personalities: Speaking the Same Love and Money Languages. And you can learn more about the book and our guests at the website. The link is at focusonthefamily.com/broadcast.

Jim: Taylor and Megan, welcome to Focus.

Taylor Kovar: Thank you. Excited to be here.

Megan Kovar: Yes, thank you so much.

Jim: So, guys, how did you two get involved in this? I mean, it’s not like, I don’t think, you wake up or you get married and say, “Honey, I got an idea for us. Why don’t we become financial, um, coaches and planners?”

Taylor: Yeah, it was not an overnight thing. Um, and I am a certified financial planner. So, my wife, uh, Megan, she’s more of a stay-at-home mom, so she is along for the ride a lot of times, well, on the finance side of things. Um, she’s much more of the writer and I’m more of the speaker, um, but she is a tremendous asset when it comes to working with couples. And…

Jim: Well, hang on a second. I got to… You know, you can lay out the financial plan-

Taylor: Yeah.

Jim: … but if Megan doesn’t do it… (laughs).

Taylor: That’s it. Yes.

Jim: So, you must be a good partner in that when you have agreement on this plan, you c-…

Megan: Absolutely.

Jim: Yeah.

Megan: Absolutely. We learned early on that we did not speak the same language when it came to money, and we needed a lot of help in order to get on the same page. So, this is how some of this was born.

Jim: In fact, we did a little research in the book and (laughs) found that you, you like Mustangs.

Taylor: Uh-

Jim: I was a-

Taylor: … I did.

Jim: … Camaro guy-

Taylor: I did like-

Jim: … but go ahead.

Taylor: … Mustangs. I did. So, yes.

Jim: You actually wanted to buy a Mustang.

Taylor: I did, yeah.

Jim: (laughs)

Taylor: So, you know, being young and in love… So, Megan and I started, dating, at 14, so we had practically-

Jim: Oh, wow.

Taylor: … raised each other.

Jim: That’s awesome.

Taylor: And, um…

Megan: And we put dating in quotation marks because at that point, there were no cellphones, no internet. I mean, our dating consisted of meeting each other at church every Sunday.

Taylor: Yeah. And, and so, dating was… you know, we use that term loosely, but since 14, we had been together. And I… We got… We were getting older, and I was like, “Hey-”

Jim: Like 16, 17?

Megan: (laughs)

Taylor: 16, 17, exactly (laughing) yes.

Jim: Much older.

Megan: Practically grown.

Taylor: Much older, yes.

Jim: Thinking about Social Security?

Taylor: Yes.

Megan: Yes.

Taylor: Thinking we were, we were grown.

Jim: (laughing)

Taylor: Um, and I, I thought it would be a great idea to surprise this woman that I was hoping to marry by buying a brand new car because I could finally afford it. And, um, so, I went out, and Ford had just came out with a brand new Mustang body style in 2003, 2004, and I didn’t really tell her. And instead, I just went and picked it out, and had to have my dad co-sign because I had no credit and, really, no money. And I couldn’t afford it, but it was cool.

Jim: (laughs)

Taylor: And I thought she would think it was really cool. And so, I bought this car, drove to her house, and what I thought was gonna be, “This looks amazing,” like, you know, show of gratitude and, “You’re so awesome. You’re the coolest guy ever. So glad I get to marry you one day, hopefully,” um, again, at 18, instead, was the complete opposite of, “What, what, what, what, what were you doing? What were you, what were you thinking when you bought this car? I didn’t… You can’t even afford rent. Why are you buying a car?” And, um, it really did not turn out the way I thought it was going to.

Jim: Huh, you know-

Taylor: Yeah.

Jim: … going back a minute, uh, you were, kind of, saying you’re the, uh, finance guy and-

Taylor: Yeah.

Jim: … it sounds like Megan might have a-

Taylor: (laughs)

Jim: … good sense for finance here.

Taylor: She did. So, my financial journey started then, um, and that’s what led to today, because I had not thought a thing about money growing up. My parents were blue-collar workers, great salt of the earth pe- people, uh, that really lived paycheck to paycheck. You know-

Jim: Yeah.

Taylor: … gave a lot of money away. And, and just that was it. They lived on overtime. And that’s how I was raised and, um…

Megan: He also came from a large family. There’s nine children. So, I don’t know if you can necessarily save a lot when you have that many…

Jim: Yeah, you got to stretch every dollar-

Megan: Right.

Taylor: Yeah.

Jim: … in, in that context.

Taylor: Yes.

Jim: You know, I, I said a moment ago that money tends to be one of the top two, three, uh, points of conflict in marriage, but you say couples really aren’t arguing about money. What are they arguing about?

Taylor: For us, it’s really about how they… how people think about money and how we talk about money or the lack of talking about money. Um, and so, a lot of times, it, it’s not so much that they spent the money on maybe the Mustang. In this case, it was.

Jim: (laughs)

Taylor: Um, o- oh, but… or, you know, the Camaro or the Starbucks coffee. It’s really that you didn’t communicate to me about that or why you feel like you need X, Y, or Z. Um, and that ends up causing a lot of problems in marriages.

Jim: Why do think budget is such a bad word in a marriage? Yikes, budget.

Megan: I think that people see budgets and think it’s, it’s rules for them. They’re adults. They’re making the money, so why should I be given rules as to how I’m spending that money?

Jim: Oh, that’s insightful. Yeah, that’s true. We don’t like accountability, do we?

Megan: Right.

Taylor: Yeah.

Jim: So, you speak about money relationship. What, what is a money relationship? Like, me and my banker?

Megan: (laughs)

Taylor: Uh, a lo-… you know, you and your spouse.

Jim: Okay.

Taylor: Uh, you know, we, we talk about a lot with marriages in general. And, and we’re big advocates of, of marriage conferences and investing in your marriage. And what a lot of people think is, “Oh, well, you know, we’re having date night, and, you know, we are physically intimate, and, you know, we have time away, and we go on vacations, and we communicate,” but it’s really that money relationship that a lot of people just forget about. We, we don’t bring up. Uh, some of it is shame and guilt because we spent money we shouldn’t have had, um, or we’re hiding money that, um, you know, we have or don’t have. And so, that, that money relationship really drives a big part of the trust that goes on between a husband and a wife.

Jim: It’s true. It, kind of, cuts through the fog. And i- i- if there’s conflict there, there’s something you need to work on-

Taylor: Yeah.

Jim: … right? You knew an older couple. I think they’d been married more than 40 years if I remember correctly.

Megan: Right.

Jim: And they had all this, um, kind of, misery in their marriage, but they had plenty of money. So, you know, for the couple starting out going, “All we need is more money, and we would be happier, and have a better marriage,” doesn’t always work that way, right?

Taylor: No.

Megan: No.

Taylor: It does not.

Megan: Absolutely not. I think, so often, everything comes back to communication. Not only if we have more money, we’ll do better, but also, some people think, “If we have a child, our marriage will be fixed. If we have a different job, if we have a new friend group.” And it all comes back to communication.

Jim: What happened in that man and his wife’s situation? M- Married 40 years and had lots of money, but they were-

Taylor: Yeah.

Jim: … miserable.

Taylor: Yeah. So, what we found… You know, we were talking with this couple, and had a great financial plan, had a lot of money compared to the majority of people, you know, that, that are out there, um, and came to us one day and said, “Hey, we’re, we’re done. We’re calling it quits.” And I was like, “Hey, you’re, you’re in the prime of life, right? You’re getting to enjoy… In theory, you’re getting to enjoy retirement or about to enjoy retirement.” Um, and what it had came down to is she always wanted to see more money in the account, and he was… felt confident in where they were. And, and so, over the years, he would, you know, contribute less to his 401k when she wanted him to contribute more. And it was just always, kind of, underlying there. And as they were getting closer and closer to retirement, she realized, “I wanted to see a bigger number there.” Um, and even though as a… their financial advisor, I was like, “You’re very safe. You have a very safe nest egg. Here’s all the, you know, the, um, the scenarios and everything. Everything looks really good.” She wanted to see more. Um, and I don’t know if it was really so much she wanted to see more, or she just wanted to feel heard. She wanted to feel, um, that he understood where she was coming from. And, and he never took that approach.

Jim: Yeah.

Taylor: He always just said, “Look, we’re, we’re putting 4%. It’s enough. We’re putting back 7%. It’s enough,” and never really explained maybe, “Hey, babe, I understand you feel that way. How, how can we come to an agreement here?” right?

Jim: Yeah.

Taylor: “If we put 5% in instead of 4%, and I could still use the other percentage on something else.” Um, they never really had those conversations, and ultimately, it led to them being divorced right when they’re about to be able to-

Jim: Seriously-

Taylor: … really enjoy retirement.

Jim: … they did divorce?

Taylor: They did, yeah.

Jim: Oh, my goodness. That’s a, a sad outcome.

Taylor: It is, yeah. It was very sad. And, um, you know, a lot of it comes back to communication of where… Um, and that really opened our eyes to why are couples feeling this way? There’s something-

Jim: Yeah.

Taylor: … ingrained in us that we think different about money.

Jim: Well, and part of it’s talking about it. It’s why we’re talking about it today because we don’t you, the listener or viewer, to be in that spot, you know, be married 40 years, and look at things differently and have this conflict where it’s insurmountable. I mean, that’s not the goal for us as Christians particularly. You do something in this book which I think is really good, and that’s put personality to money types (laughs).

Taylor: Yeah.

Jim: I mean, uh, you know, I don’t know if this is 100% accurate, but let’s talk about those five personality types and give a little description to each one.

Megan: Sure. So, there are five, uh, money personalities that we have discovered. And that starts with… we have a saver, spender, risk-taker, security seeker, and also a flyer.

Jim: Oh, I just like flyer already (laughing).

Taylor: Yeah.

Jim: That sounds like a fun one.

Taylor: It sounds fun, right?

Jim: Yeah, yeah.

Taylor: They are, they are really fun.

Jim: Except you pay the piper.

Taylor: You do. Yeah.

Jim: Yeah.

Megan: Yes.

Taylor: And so, uh, after interviewing literally thousands of couples, right, and we’ve done this, um, we’ve identified these five different money personalities that are out there. I mean, a lot of people, when you talk about how you think about money, it’s usually saver and spender, right?

Jim: Right.

Taylor: And that’s usually where people stop.

Jim: Yeah.

Taylor: Well, I’m a saver, she’s a spender, and that’s all it comes down to.

Jim: Well, and every saver is a spender to a degree-

Taylor: To a degree.

Jim: … because you got to-

Megan: Right.

Jim: … spend money.

Taylor: You got to spend money.

Jim: And, and, a- a- a-… Right. And then every spender has to hopefully save something.

Taylor: Yeah.

Jim: Right.

Taylor: And so, what, what we found is, is everybody has two money personalities. You have a primary and a secondary-

Jim: Okay.

Taylor: … that, kind of, jump out, right? Um, that’s how we put it. So, Megan is a saver security seeker, then I tend to be a spender risk-taker, which are ver-… two very opposite ways-

Megan: Total opposites.

Taylor: … of thinking about money.

Jim: We’re already hearing conflict (laughing).

Megan: Yes.

Taylor: Yes, yes. Uh, ever since then from the Mustang, right?

Megan: (laughs)

Jim: Ever since then. Yeah. That was a tell.

Taylor: It was.

Megan: Yes.

Jim: (laughs)

Taylor: Yes, very much so. Um, and so, savers, you know, the, the very basic. They like to save money. They… Like the woman in our story, she wanted to see the money in the account. Um, she wanted to see the hard dollars there. Um, didn’t really care to see it in a, uh, rent house. She wanted to see it in the account. Um, and so, savers. Meg is a great example of a saver.

Jim: (laughs)

Megan: Yes. So, I am a saver and, um, I’m also a tad bit of a security seeker. But as a saver, um, of course, like everyone knows, we love to save money. Taylor is very big on, well, we are saving money. We are putting money away by investing in this real estate or investing in land or different things, but for me, I want to see the money in the account. I want to know how much is in the account at all times. One of the things that definitely gives me away as a saver is I love to go out and have a good time, but it’s gonna be on a budget. Like, me and the kids, every summer, we, like, look at the movie theater schedule and see that they have $1 summer movie coming.

Jim: (laughs)

Megan: Now, we have already watched all of these movies because they’re from last year-

Jim: Oh, yeah.

Megan: … so we’ve already seen-

Taylor: Oh, yeah, yeah.

Megan: … the movies, but we’re going to go because I know for $1, we can watch the movie for $1, we can get popcorn and soda, and we’re gonna have a great time. And to me, that satisfies my little bit of spender, but also lets me know that we’re having a great time and saving money at, at that time.

Jim: Uh, help me understand how our faith… And this is really critical because, you know, you, you can be a good Christian and be a saver. You probably will pat yourself on the back maybe a little more than your spouse who may be a spender, but, you know, they’re still saved in Christ, right? (laughs)

Taylor: Yeah.

Megan: Right.

Jim: So, how do we, how do we recognize different personalities, and then, kind of, pull some of those more outrageous attributes in a little bit to give them some discipline, I guess?

Taylor: Yeah. I, I think a lot of that starts with, you know, understanding what your… how you think about money. Um, you know, we can say, “I’m a saver. I’m a spender,” but in reality, if, if, if you don’t really know, you haven’t studied it or, or took the time… And we do have a, a free assessment online, um, at fivemoneypersonalities.com, where you can go and take the assessment.

Jim: That’s great.

Taylor: It just takes a few minutes. Um, dives into your money personality. And so, we use that to, um, one, start the conversation. And, you know, all throughout the, the scriptures, there’s examples of savers, and spenders, and flyers, and, and all of these different money personalities. And so, once we know how we think about money, um, and we’re able to communicate that, it really opens up that communication between a, um, a hus- husband and a wife. And so, that’s where we usually start is-

Jim: Yeah.

Taylor: … let’s take the assessment, let’s figure out where we are, and then let’s utilize some resources that are at our disposal to communicate better. We find a lot of people wanna have hard money conversations at the most inopportune times.

Jim: Mm-hmm.

Taylor: You know, I come home, because I’m a risk-taker, and I’m like, “Hey, I got this new business idea. Let’s… you know, we’re gonna do this.” And I walk in the door, because I’m all excited about it, and Megan’s sitting there trying to cook dinner, and, you know, the house is a wreck because of the kids that had just walked in from, you know, playing out- outside, and everything’s just crazy, and I’m trying to throw this i-… business idea at her. And it’s like, “Hey, that’s, that’s not the right time,” right?

Jim: So, that’s a whole different problem.

Taylor: A whole different problem.

Jim: Timing is, is…

Taylor: Timing is a, is a, is a very big problem. And so, um… But getting on that same page-

Jim: Yeah.

Taylor: … understanding, “Hey, let’s, let’s find a time that works for both of us. Let me make sure I answer the questions before you have a-”

Jim: So, let me just make sure. So, you don’t, like, set candles up in the bedroom, and you come to the bedroom, and go, “Honey, I’ve got a great deal for us,” (laughs).

Taylor: Not for the financial talk.

Jim: That’s a different thing, right?

Taylor: Yeah, that’s a different, yeah, that’s a different time.

Jim: I can imagine this. You, you get… snuggle in the bed and go-

Megan: That’s not gonna be romantic.

Jim: … “I’ve a… an eye on a piece of property that I think would be-”

Taylor: That’s right.

Jim: “… great.”

Taylor: Yes.

Jim: “What do you think?”

Taylor: Yeah.

Jim: (laughs)

Megan: Now, he has, he has done that without the candles, but I would definitely say crawling into that is also not the perfect time to have these conversations.

Jim: See, this is good advice, John.

John: And know your spouse to have a little bit of, uh, EQ about what’s going on.

Jim: (laughs)

Taylor: Yes.

Megan: Yes.

John: Leave the situation before you share-

Megan: Yes.

John: … the big idea or have the big conversation.

Megan: Yes.

John: But we’re… we’ve been married… Dena and I have been married 40… almost 40 years, 39. And we have these conversations. And we’re different. And so, I’m really grateful for what you all are, are doing. Uh, Taylor and Megan Kovar are our guests today on Focus on the Family with Jim Daly. And they’ve written a book that’s really, uh, designed to help you better manage your money with your spouse. And the title is The 5 Money Personalities: Speaking the Same Love and Money Language. Get a copy of that when you call 800, the letter A and the word FAMILY, 800-232-6459, or stop by focusonthefamily.com/broadcast. And over at our website, we’ve got a free marriage assessment. Uh, it’s a quick survey maybe takes five or 10 minutes of your time, and it’s gonna give you a really good overview of what’s working well in your marriage and some areas that you might want to improve in. And, uh, we’d recommend you check it out at marriagemilestone.com.

Jim: Let me, let me ask you. We’ve… you know, saver, spender, pretty obvious, risk-taker, pretty obvious, security seeker, that’s, you know, put it under your pillow, put it in the mattress kind of person, safe, safe, safe, and then that flyer. Flyer can be interesting because you’re saying there, that person’s not motivated by money but very content with life, uh, big on relationships, happy to let someone else take care of the finances. That sounds like a committed Christian to me.

Taylor: It is.

Jim: (laughs)

Taylor: Yes.

Jim: As a flyer.

Taylor: That’s right.

Jim: No, I just wanna say, too, do some of these conflict… like, I could see somebody, it’s almost schizophrenic, but a spender security seeker.

Taylor: It is. So…

Jim: Can you have that combo?

Taylor: You can. Yeah. And so, what we say is everybody has a primary and a secondary. And that primary is, is how you think about money 90-plus percent of the time, right? So, that’s, that’s how you are day in, day out. And that secondary one pops up usually on the… in times of stress, usually when you’ve had a bad day. And so, um…

Megan: We like to call it the backseat driver. It’s like pumping… trying to pump the brakes on things sometimes that-

Jim: Yeah.

Megan: … 10% of the time.

Jim: I’m thinking of somebody in the aisle going, “Buy it. Don’t buy it. Buy it.”

Megan: Yes.

Taylor: Right.

Jim: (laughs) I mean, they’re like, “Wow, what am I doing?”

Taylor: Yeah. No, typically, you know, when somebody’s had a bad day, and they say, “Man, I just… you know, I deserve a good meal.”

Jim: So, they’re comfort buying.

Taylor: Comfort buying.

Jim: Oh, okay.

John: Retail therapy is what I call it.

Taylor: Retail therapy, yes.

Megan: Right.

Taylor: So, those are the ones that jump out.

Jim: You, guys, are so well-educated about this.

Taylor: Yes.

Jim: Um, moving to Scripture, which is really critical (laughs). You know, how does God see these personalities? I think Philippians 4 is a good place to ask this question where, of course, Paul’s writing and says, you know, “Be content in every situation.” I’ve learned to be content if I have a lot, or if I have a little. Um, how do we find that contentment in a culture that is saturated with consumerism?

Taylor: You know, I think… Ecclesiastes is one of my favorite books in the Bible. And I think it speaks to that really well, especially to today where, you know, we think, “Oh, if we have more money. Oh, if we have this nicer car. Oh, if we had more vacations,” or, you know, where we’re idolizing people we see on Instagram and, and social media, “If we just had that, you know, we would be set.” And the s-… you know, Ecclesiastes does an amazing job of saying, “Hey, I’ve had all this, right, because I’ve had, I’ve had everything you can imagine, but it all comes down to our relationship with God, right?” If we, if we keep him number one, and, and really the center of all that we do, we can be content in all situations. Um, if we just give him our fears, our worries, our concerns, our joy, everything becomes a lot more in focus.

Jim: Um, in your book, The 5 Money Personalities, you address something called financial infidelity. I mean, that sounds like a big hot word, infidelity, obviously. What’s financial infidelity?

Taylor: You know, um, for us, financial infidel- infidelity comes from, one, a lack of communication, but when we think of infidelity, most people think of physical infidelity.

Jim: Correct.

Taylor: A- And we don’t think, “Well, financial. Well, me spending this money and my spouse not knowing about it is not nearly as bad as me having some other type of an affair,” um, but in reality, a lot of those same emotions come up, uh, when those… when financial infidelity occurs. And so, you know, we, we talk about financial infidelity in a few different ways. So, one being hidden expenses, right, hidden credit card debt, hiding, um, cash, or even controlling. So, we worked with a couple one time where, um, he… we’re talking with them, and he says, you know, “I go through McDonald’s for lunch sometimes, and my wife will call me and say, ‘Hey, why did you get a large drink?’” is… that… just that controlling of money. And so, financial infidelity can take a lot of different, um, avenues.

Jim: Yeah.

Taylor: It can pop up in a lot of different ways, but it, it does bring about a lot of the same insecurities, all the same emotions that other types of infidelity could.

Jim: In an unscientific way, when you look at the number of couples that you’ve talked about, it, it… I guess it’s a little startling to me that, um, what I imagine would be a, a fair number of couples that do have hidden accounts or money stashed away and they don’t talk together as a couple about, is that pretty common?

Taylor: It is. So, uh, statistically, we show about 65% of, uh, especially women, have a hidden credit card or hidden debt.

Jim: What is that saying when they do that?

Megan: I think that it stems from generations of, um, women teaching the younger generation to have that mad money, that safety net, just in case something happens that they’ll have a little money set aside in case the marriage doesn’t work out.

Jim: Wow.

Megan: I think that some of it stems from that. And then, of course, other… it also stems from, um, the feeling of, “I know better than he does. So, he’s spending the money in a way that I don’t feel it should be spent. So, in order to have that safety net, I’m going to have to take it upon myself to start saving away.”

John: I was just gonna say that sounds like there’s not communication again, right?

Taylor: Yeah.

Jim: And…

Megan: Yes. It always boils down to communication.

Jim: In that context, too, it, kind of, leads into that fear-based situation, which again-

Megan: Right.

Jim: … is gonna be one of the roots of division within the marriage, you know, for whatever reason, but certainly money will create that, especially fear-

Megan: Mm-hmm.

Taylor: Yeah.

Jim: … regarding money. So, in that regard, I guess there’ll be two ways of looking at that. You have insecurities. Let me call it that.

Megan: Mm-hmm.

Jim: And you’ve described that. What about the other side of that, where we can’t pay our bills, we have a lot of debt? Um, how do we balance that fear and lack of confidence with the security and peace of mind that God wants us to experience? I mean, you’re in it, if you’re in that well, that deep well, that pit of debt and everything else, h- h- how do we overcome the fear of that and start working on getting rid of it?

Taylor: You know, for me, I think a lot of it comes down to a lot of people are in debt, and above… you know, in over their heads. Um, and a lot of it comes from things that aren’t biblical, you know. It’s the lust of the eye and the lust of the flesh. And so, number one, we tell people, i- if you’re in that situation, the Bible makes it really clear, we need to repent, right? W- We need to go to our Heavenly Father and say, “Hey, I messed up, you know. I, I’ve, I’ve done wrong,” and realize that it wasn’t some outside circumstances. It wasn’t your neighbor that used your credit card, right? It was you. A- And we made those decisions as a couple or independently. And really just come to that realization that, “Hey, we, we have failed. And we’re not blaming others. And let’s get on the same page.” Uh, we’re, we’re big proponents of, “We’re on the same team. If you’re in that pit of despair, a lot of times, you got to realize, “Hey, we’re on the same team. We got into this together. We’re gonna get out of it together.” Uh, and, and really sit down and work on that plan, but from an aspect of realizing we got ourselves into this.

Jim: Well, and let me stress that point because what you’re saying is, yeah, you’re on the same team, but in this context, you can really be divided.

Taylor: Yeah.

Jim: And that’s not a healthy way to solve the problem, uh, of how do we get out of debt? Uh, you talked about a money dump. Um, boy, it sounds like fun. Where can we go?

Megan: Doesn’t that sound great?

Jim: (laughing) I don’t think that’s what you’re talking about, but that does sound like fun. But what’s your version of the money dump?

Taylor: Yeah. So, the money dump is, is where we want couples to get together at least once a year, right? And we, we say once a year to really just dump it all out, right? Let’s just get all the fears, all the insecurities, all the issues, all the worries out on the table. Let’s just dump it on the table. And let’s come. Let’s talk about it.

Jim: What does it sound like? Give me a how between a husband and a wife.

Taylor: Um, for us, that means, “Hey, we’re not gonna have the kids around.” Right? Um, it’s something that we’ve planned. And so, we have thoughts together. So, it’s not spontaneous, you know. It’s not bringing up a bunch of old fears or concerns. It, it’s really, “This is where I am right now. And this is why.” Um, so, we’ve thought about it. We’ve written out some ideas. And we’re having a, a really good conversation about it. And so, that money dump, it, it just helps to ignite the conversations and help to keep the couple, um, back on the same page. And, you know, people say, “Well, that’s only once a year. You know, you’re doing it… You only talk about money once a year.” It’s like, no, we also have a thing called the money huddle, um, which is where we recommend couples. They come together. They huddle up, you know, five, 10, 15 minutes a month, and just say, “Hey, this is where we are, you know. We’re, we’re, we’re moving in our budget. We’re making progress.” It’s not an overnight thing. There’s not a switch we can flip and everybody just become a millionaire. Um, it is a progress. And so, uh, between the, the money dump and then moving toward a money huddle on a once-a-month basis, uh, it really helps keep those lines of communication.

Jim: Well, I like those football analogies. It used to be playing in the street. You’d say, “Go buy the Chevy and turn around and…”

Taylor: Oh, yeah.

Jim: Oh, yeah, yeah. Now, we’re saying, “Go buy the Chevy.” (laughing) That’s a different huddle.

Taylor: A little… Yeah, a little different.

Jim: Um, it’s really important. Uh, we’ve said this already, but it, uh, bears repeating, I think, conflict about money in your marriage, it, it is inevitable. I’s gonna happen. I like that idea of getting out there and getting ahead of it and having these discussions. And that’s what you mean by the money dump.

When I was looking for those examples, it’s like, “Honey, I think we’re in a good place,” or, “Honey, maybe we’re not. Do you feel the same way?” That would be some of those discussions, or maybe, “We’re not saving enough,” or, “Maybe we do need a dryer. How are we gonna pay for that?” or something like that.

Taylor: It is.

Megan: That’s where you would go over…

Jim: Matter of fact, I used that because we need a dryer.

Taylor: Yeah.

Megan: (laughs) That’s where you would go over different goals for the family and things like that as well because typically, some of the goals aren’t just gonna come around without money involved in those goals. So, that’s where you would discuss also how much we’re spending on the children’s soccer lessons or private schools or whatever may come up.

Taylor: Yeah. And we’ve created some really great resources to help couples to open those lines of communication. And so, uh, we have questionnaires that couples can use to help start that, and just say, “Hey, this is the basis of this money dump.” Right?

Jim: Yeah.

Taylor: Um, and it really opens lines of communication.

Jim: And that’s critical. I mean, I think that’s what it’s about, uh, whether it’s money, intimacy, faith, uh, having that open line of communication is critical. Obviously, we want you to pick this, uh, book up, The 5 Money Personalities. I think you’ll love it. Uh, it’s just really well done. And, you know, when you look, again, at the conflict in marriage, and, and money being right at the top of the list, or near the top of the list, why not attack it head on? And we want to get this into your hands. If you can make a gift of any amount… And, and if you can’t afford it, ask us for the book, because we understand you’re in a money crunch, but if you can make a gift of any amount, $5, $10, we’ll send it as our way of saying thank you for being part of the ministry. And as I said, if you can’t, we’ll get it to you and trust others will cover the expense of that. I think it’s one of those tools you need in your marriage arsenal. So, you can go to it and improve the communication in your marriage around money.

John: Mm-hmm, yeah. And thanks in advance for your generosity. And please donate and request the Kovar’s book when you call 800, the letter A and the word FAMILY, 800-232-6459, or stop by focusonthefamily.com/broadcast. And we also mentioned our free marriage assessment, which is a great way to, kind of, get on the same page with your spouse about what’s most important in your relationship, how things are, and maybe areas that you’d like to see some improvement in. Uh, take it together and engage, have some great conversations about this marriage assessment. We’ve got all the details on the website.

Jim: Taylor and Megan, this has been really good. I so appreciate you making the time to be here, coming up from Texas, and spending a little time with us. I hope many, many couples are helped through your great advice. Thanks.

Taylor: Thank you all. Thank you.

Megan: Thank you so much for having us.

John: Well, plan now to join us tomorrow as we’ll explore simple ways that you can show love and kindness every day of life.

Karen Ehman: And then he looked up at me, visibly choked up, and he said, “Do you know what? I have been a mailman on this street for 33 years. And no one’s ever done anything like what your family did for me. Thank you.”