Preview:

Chuck Bentley: I realized that money was in fact in control of my life. And I wept privately for the realization that I really was serving money, and in love with money, not God.

End of Preview

John Fuller: Well that’s Chuck Bentley reflecting about the mindset he once had about money and possessions. And, if you’re struggling with finances in your marriage, stay tuned. We have an encouraging program for you today. This is Focus on the Family with your host, Focus president and author Jim Daly, and I am John Fuller.

Jim Daly: John, we hear from so many married couples who, um, struggle in this area of financial difficulty. I mean, it’s in the top three, depending upon the survey you look at. But, uh, financial problems are right there at the top. And, uh, for whatever reason, uh, many husbands and wives aren’t on the same page financially.

Jim: You know, so often we talk about our differences and how you’re an extrovert and you marry an introvert, et cetera. Those are general principles. I know that some people, some couples don’t hold true to that. And I ac- acknowledge that. But it’s true with finances true, you usually have a spender and a saver, and that creates great conflict.

John: Mm-hmm.

Jim: Especially when money’s tight in the early years of marriage. But it can take, literally, years to resolve that and to do better in that area. There are some simple things you can do to get on a better pathway. And the earlier in your marriage that you do it, the better off you’re gonna be, for obvious reasons. You’ll have more peace in your home.

John: Mm-hmm.

Jim: And we’re going to, uh, explore those things with our guests today.

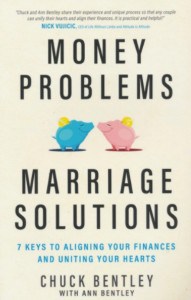

John: Yeah, Chuck and Ann Bentley have been married for over 40 years. And, uh, they say it has taken them a long, long time to work out their money and relational issues. And, they’re very candid about their story. Uh, Chuck is the CEO of Crown Financial Ministries and has counseled thousands of couples about finances. And, uh, together with Ann, uh, he’s written this book, Money Problems, Marriage Solutions: 7 Keys to Aligning Your Finances and Uniting Your Hearts. And we have copies of that here at the ministry, focusonthefamily.com/broadcast or call 800, the letter A, and the word FAMILY.

Jim: Chuck and Ann, welcome to Focus on the Family.

Chuck: Ah, thank you. It’s pleasure to be here.

Ann Bentley: Thank you, Jim.

Jim: It’s good to have both of you. This is that common topic. I mean, we do cover this from time to time, regularly, because it is one of the core problems that crop up in marriage. Uh, describe for us if you will, I mean, the early years for you, kind of paint the picture for the viewers, the listeners, about where the Bentley’s were at (laughing) early on and what were some of those issues that, uh, cropped up in your marriage about finances?

Chuck: Well, they say out of your misery comes your ministry, Jim.

Jim: (Laughs).

Chuck: So, I- I would say misery describes sort of where we were. We loved each other. We met and married, uh, very quickly. Uh, I asked Ann to marry me after six weeks-

Jim: Hmm.

Chuck: … of knowing her.

Jim: Okay. Hang on a second. Ann, is that true?

Ann: Yes it is.

Jim: What did your mom and dad think of that?

All: (Laughing).

Ann: Well, uh, I didn’t really ask. We were still-

Jim: (Laughs).

Ann: We were still in college. I knew better than to ask.

Jim: Right.

Ann: Um we were-

Jim: I’m sure.

Ann: Okay.

Jim: Wh- was that a shock for you, though? I mean it- I’m sure you were in love and moving in that direction. But six weeks is a pretty, pretty quick moment to go, “Okay, do you wanna make this permanent?”

Ann: Uh, we were, yeah. We were in agreement.

All: (Laughing).

Jim: That’s good. That’s good.

Chuck: But we didn’t know each other-

Jim: (Laughs).

Chuck: … Jim. And, we knew we loved each other, and that’s always held true. We’ve always loved each other. Uh, but as you know, opposites attract. And then after they get married, they attack. And you know-

Jim: Hmm.

Chuck: … so, I was, uh, difficult to live with. And, when it came to money, I had a very stubborn view of it. So I treated Ann like I was the right opposite and she was the wrong opposite. Like I … we’re totally different. But my view was, “If she would just be more like me, then we would get along.”

Jim: You’re a classic. (Laughs).

Chuck: And, I treated her that way for many, many years.

Jim: Hmm.

Chuck: I mean, I expected her to become like me. And so she lived under that sort of oppressive view of, uh, financial difficulties we were having. I was causing them. She was trying to solve them. But I didn’t give her the space to do that.

Jim: Well that’s important. Describe for us your, if I could say it this way, your financial personality.

John: Hmm.

Ann: Oh.

Jim: That might help us better understand you as a couple. So an, what- what was your approach to money?

Ann: I grew up in a home of school teachers. So we were savers. And I never knew that we didn’t have much growing up. You know, I was born in the ’50s, so back then-

Jim: But money was tight, it … you know-

Ann: Yeah, but I didn’t know it, Jim.

Jim: Okay, yeah.

Ann: We just lived very frugally.

Jim: Yeah.

Ann: Totally different from Chuck’s upbringing.

Jim: Hmm.

Ann: And it didn’t dawn on us until later in our marriage, how differently we had been raised, and why that had affected how we viewed money.

Jim: Well what was your Chuck? What was your-

Chuck: Well she’s the classic saver. And I’m the classic spender.

Jim: Okay.

Chuck: I’m the big spender in the family.

Jim: Right.

Chuck: I like to spend money. Uh, I have big dreams, big goals, big ideas. If it’s got four-wheel drive, camouflage, or any of those kinda things, then I would wanna buy it. And, uh, I’m a risk taker. I grew up in the oil and gas business. That’s my family background. So, when Ann and I married, I was ready to take a lot of risks. And she was always driving with her foot on the brake. So it immediately caused conflict.

Chuck: I really didn’t even know how to save. It wasn’t in my worldview that we needed to save money for the future. It was, “We need to invest and take a lot of risk.”

Jim: But this conflict went on for quite some time, right? I mean-

Chuck: Years.

Jim: I mean, like, a decade?

Chuck: No, two decades. (Laughs).

Jim: Okay, no, and I think that-

John: Wow.

Jim: … you know, there’s a realism in that. And I appreciate that being the case. Because, these aren’t things that you can kind of unwrap easily and then put back together. And Ann, during this time, I mean, 20 years of being married to a spender when the dollars weren’t necessarily there, how did you … how did you approach things? I mean, how did you go to Chuck and say, “Honey, we got a problem?”

Ann: Well, I was raised in a churchgoing home, but I was Biblically illiterate. And by the grace of God, some women invited me to a Bible study. And it’s where I first started learning what God said (laughs)-

Jim: How many years-

Ann: … in his word.

Jim: … had you been married at this time?

Ann: Oh goodness. I think I was … 30 when I started. That … it was in a Bible study. At that point we had baby number 2, we’d been married nine years.

Jim: Okay. So nine years in, which, you know.

Ann: Mm-hmm.

Jim: You should have some maturing, uh, signals there.

Ann: Right.

Jim: But here you are in this Bible study and what happened?

Ann: And then, um, it wasn’t immediately, but several years later, an older woman said … and she didn’t even know that I was going through anything. She was talking to a group of us and just said, “You know, it’s not wise to nag your husbands.” She said, “It’s always better to just pray first. Go to God with it. Ask him to work it out.”

Jim: So that moment, I mean that woman said that, and then you s- thought about that. How did it change your behavior?

Ann: Oh, I started praying. I just took it to the Lord.

Chuck: We went through a lot of financial pain, Jim. I went on the course that I thought was best for us. And so I would make investments or decisions that didn’t work out.

Jim: Mm-hmm.

Chuck: And we would live on the financial edge.

Ann: Mm-hmm.

Chuck: And it was … it made Ann feel very insecure.

Jim: Mm-hmm.

Chuck: And looking back, I see why she was trying to get my attention, but I was just too stubborn to listen. I think I had that mindset of, “I need to have the answers and I don’t need to ask anybody for help.” So I was insular. I was trying to figure everything out myself. I wasn’t listening to her, and unbeknownst to me, she had just sort of given up. And she was praying for me, that God would get my attention. And what’s interesting, Jim, is even though we had a lot of financial pain, I would just double down. You know, some people go through financial pain and they say, “Okay, I’m not gonna do that again.” (Laughs). I would just sort of keep adding-

Jim: Well that’s your risk taker attitude.

Chuck: No. Yeah-

Jim: “I’ll get it all back.”

Chuck: “I’ll get it all back.”

Ann: Well your solution was to just make more money.

Chuck: Yeah. My … always, I mean, I was driven by more.

Jim: Yeah.

Chuck: And more would solve the problem. And quite frankly, I really thought it would. I thought the more successful I became, the happier Ann would become. And little did I know-

Jim: Hmm.

Chuck: … the more successful I became, the unhappier she became. And I didn’t know how to solve that problem.

Jim: Let me ask you in that regard, that’s really interesting, because I think most men would have that sense, that equation. H-h-how did that revelation then come to you that, that was not working? Your formula was not her heart’s ache?

Chuck: I’ll tell you a story, Jim, that really made it so apparent to me. We went out for our wedding anniversary. I think it was around 20, 21 years. And we went to our favorite spot (laughs) our favorite restaurant. And, we’re having a great celebration of our marriage. And one of my clients walked into the restaurant. And out of the corner of my eye I saw him standing over there, and I looked at Ann and I said, “Excuse me.” And I went over and started talking to my client. And I was super excited that we were, you know, gonna do a deal soon. And when I came back, I didn’t realize it had been 15 minutes. And Ann was crying in the booth, and I didn’t know why she was crying.

Jim: Let me, uh, guess. (Laughs). It was your anniversary.

Chuck: It was our anniversary, and I had put the deal, and the more and the s-

Jim: Wow.

Chuck: And I was telling her how excited I was. And I really did not know why she was upset. But I had put all of that above her.

Jim: That’s a perfect expression, Chuck, of exactly a guy’s attitude. Right? “I’m doing what … This should make you happy, Ann.”

Chuck: Let’s celebrate.

Jim: “I’m gonna be bringing home more bacon.”

Chuck: That’s right.

Jim: But what did you want that night?

Ann: I just wanted-

Jim: What did you want to hear?

Ann: I just wanted time with him.

Jim: Yeah.

Chuck: And I didn’t see that. And so, that was the sort of Exhibit A of where we were.

Jim: Hmm. Was that about the time, then, you went to the Crown Financial-

Chuck: (Laughs).

Jim: … I mean, how did that-

Chuck: Well-

Jim: What was it that you went to? And when did that occur? And what was the timeline?

Chuck: Well think about this, Ann had been praying for me-

Jim: (Laughs).

Chuck: … 10, 11 years?

Jim: Wow.

Chuck: And, this Crown Class is announced in our church bulletin.

Ann: Hold on. Can we back up?

Chuck: And she tricked me into it.

Ann: Can we back up?

Jim: This is always dangerous when the wife says, “Let’s back up.”

Ann: I need to back up, because, Chuck came home one evening and said, “Ann-

Jim: (Laughs).

Ann: … “I want you to pick out our new house. I’m gonna pick out the cars.” He was in a business that he assumed, you know, that he was gonna make a lot of money within the next year. That was my red flag. We had a major issue. And so, when I saw that our church was offering this Crown course, I thought, “We need it, now.” So …

Chuck: So you called the leader.

Ann: Mm-hmm.

Jim: Wow.

Chuck: And, well, first you asked me if I would go. And I said, “I’m too busy.” And so she’s trying to get me to go. And so I just said, “Okay, if they have it on Sunday night, that’s the only time I have available.”

Jim: (Laughs).

Chuck: And I thought that would be sort of the compromise where she, you know, would think, “All right, I’m trying, but it’s never gonna happen.”

Ann: So I called the, uh, man who was organizing these classes and he said, “Ann, I’m sorry. I only have one class available. It’s on a Sunday night-

Jim: (Laughs).

Ann: … and, here’s the catch. Anyone who agrees to attend, will lead another group.” I said, “Oh of course. We’ll do it.”

Jim: (Laughs).

Chuck: So-

Ann: I … there was no way I was asking Chuck.

Jim: Yeah.

Ann: Because I knew what he’d say.

Jim: Yeah. That would be a big no.

Ann: Right.

Chuck: Yeah, and so here I am. I’m going to a class. I don’t know that she’s pre-agreed that I will lead one-

All: (Laughs).

Chuck: … after we get through it. And I was totally obstinate. I was arrogant. I wasn’t interested. I thought I knew, Jim. I thought I knew what the Bible said about money. I grew up in church. And we started opening the word, looking at the scripture, and by week six of that bible study, I repented of my idolatry of money.

Jim: Hmm.

Chuck: I realized that money was in fact in control of my life. And Ann had not been able to help me see that, but God did. And the Holy Spirit convicted me as if I had committed the most heinous of sin against the Lord. And I wept privately for the realization that I really was serving money, and in love with money, not God.

Jim: Hmm.

Chuck: And that’s what changed everything.

Jim: Yeah.

John: Wow. Well, what a story we’re hearing today from Chuck and Ann Bentley on Focus on the Family. And they’ve written this book, uh, that we’re talking about that captures part of their story. Money Problems, Marriage Solutions: 7 Keys to Aligning Your Finances and Uniting Your Hearts. And, uh, stop by focusonthefamily.com/broadcast for your copy, or call 800, the letter A, and the word FAMILY.

Jim: Chuck, I wanna pick up on that, because that’s a profound moment. And we need to understand that. I’m sure there are men and women that are listening who, maybe they came to that precipice but they didn’t spiritually cross over.

John: Hmm.

Jim: You know, they didn’t feel that conviction quite the same way. How did you find that humility in that moment to say, kind of like King David, “I am that man.”?

Chuck: I am that man. You know, Jim, I’ve never met anybody else that I’ve known in my life in all of these years of doing what I do, that have repented of idolatry of money. It was something unique to me. And something I didn’t know was happening, and Ann didn’t know how to describe it. But she sensed that was my problem. And it took the Lord to reveal to me that that’s really what was going on. My heart belonged to money, and Ann wondered why I wasn’t the spiritual leader of the home. Well, it’s because I was worshipping money. I did my devotion with the Wall Street Journal.

John: Mm-hmm.

Chuck: That’s how I lived. And once the scales fell from my eyes, I just immediately saw that we had to start over from the inside out. It wasn’t the money that would solve our financial problems. We had to solve them as a couple together. And so, we started just rebuilding from the very, very basics of our marriage. After 20 years of marriage, it started afresh.

Jim: Hmm.

Chuck: And we were just talking this morning, before we came here. It’s been a miracle. God did a complete transformational miracle. And I would say, apart from my original salvation, repenting of the love of money has been the most transformative thing that’s ever happened to me.

John: Hmm.

Jim: Yeah. Ann, that transformation, I mean, you prayed for nine, 10 years-

Ann: Mm-hmm.

Jim: … for that moment to occur. Um, it has to be a little surreal. “Is this really happening? Is he really making that change? Is he … you know, are we gonna move in a better direction?” Something that, you know, in your heart, you were hoping for. How did that feel to hear Chuck talk about his sin in that way, after you’d been praying for him for so long? I mean, were you hesitant? Or were you embracing? Or were you both? Uh …

Ann: I was just, um, grateful.

Jim: Hmm.

Ann: ‘Cause I saw the faithfulness of God at that time.

Jim: Yeah.

Ann: Uh, hoo. It was an emotional time for both of us. And we were surrounded with, um, people who were praying for us at the same time in that Crown group. I mean, he got on his knees in f- in the group and wept.

John: Hmm.

Ann: So, um, you know, it took time. There were big changes. I think I was pregnant with the number four at the time. (Laughs).

Jim: Four boys, right?

Ann: (Laughing) so I was emotional anyway, you know.

Jim: (Laughs). Well I just, I so appreciate that honesty, because I can imagine it came with a bundle of good and bad. Thinking, “Okay, is this really gonna be a change? Or is it gonna be a few days and then back to normal?” And I’m sure at times it’s a roller coaster ride, because those are habits.

Ann: You know what, Jim? I think, for me, it was all good. (Laughs).

Jim: That’s good to hear.

Ann: It was all good.

Jim: Yeah.

Chuck: You know, Jim, I’m reliving that moment, because not only did I repent before the Lord, but … I needed to repent before Ann for treating her the way I did. And I began to accept her. I realized she had been right and I had been wrong. And I grew to so deeply appreciate her willingness to persevere through my arrogance, uh, my stubbornness, my demanding my way, and sort of living on the edge. And I … it was like I looked at her one day and I thought, “Oh my goodness. You’re exactly what God knew I needed. I needed you-”

Jim: Hmm.

Chuck: … “to be complete.” And she had just persevered long enough til I realized what a wonderful, beautiful, Godly asset that she was as my wife. And that’s why we wrote this about marriage, because we were just really operating on half of the horsepower of our relationship, because she was excluded from helping.

Jim: Man.

Chuck: And once we came together, everything changed, dramatically. Our intimacy, our ability to get along, our financials, uh, changed. I mean, we, you know, we weren’t in financial trouble. But in a sense we were because we were so … I was so far off of God’s path that I was going in the wrong direction.

Jim: Yeah.

Chuck: And that- and that’s what brought us back together as a couple.

Jim: And it’s- there’s so many elements here. The stubbornness of man’s heart. And what I appreciate about what you’re expressing, there has to come a breaking point. And that’s what intrigues me about your story, your ability to zero in, through your idolatry, through your, uh, pride, God gave you that ability to see what was true.

Ann: Mm-hmm.

Jim: And you realize it, and you go, “Wow. That is my heart.” Let’s move to the practical help. You had seven keys to uniting in marriage. And we’re not gonna be able to cover ’em all in a few minutes here. But let’s start that and then encourage people to get the book, which is great. It’s a quick read. Um, Money Problems, Marriage Solutions: 7 Keys to Aligning Your Finances and Uniting Your Hearts. I man, (laughing) that’s pretty bold proposition. But, let’s get into it. The first was peacemaker.

Chuck: I think that I was avoiding peacemaking. And we realized that as long as we stayed in conflict, we would never make progress. And so, we came up with some ways to practically put that into action. I tell people, “If one of you is a peacemaker you’ll survive your marriage. But if both of you are peacemakers, you’ll start to thrive.” And so we came up with the first to apologize is the bravest.

Ann: First to forgive is the strongest.

Chuck: And the first to forget is the happiest. And so, we sort of had this little thing going of who would apologize first. Because, you know, it’s so interesting how hard it is to apologize when you’ve offended each other.

Ann: So even today, when … to apologize, I have to go away and think about it before I- I want to (laughing) apologize.

Chuck: Yeah.

Ann: You know, it doesn’t come naturally.

John: Mm-hmm.

Jim: Well, and you want to make sure it’s true.

Ann: Yes.

Jim: I could tell that you and Jean have very similar hearts.

Ann: Mm-hmm.

Jim: You want to make sure if you apologize, it’s coming from the core of my being.

Ann: Right.

Jim: It’s not superficial.

Ann: Yeah.

Chuck: So the baseline is we started to make peace with each other so we could attack the problem. Secondly, I had to go through a redefinition of prosperity.

John: Hmm.

Jim: And this is the second-

Chuck: What did God-

Jim: The second financial priority.

Chuck: The second priority, because what had happened to me is, uh, prosperity was how much was in the bank account and it was all external, the next bonus the- the next, uh, investment, everything that I considered a prosperity was wrong. Ann’s definition was in the home. And so we went to Jeremiah 29 and looked at, this … and when you get to the famous verse, verse 11. You know that everybody says, you know, they wanna claim is, “I know the plans I have for you, declares the Lord, plans to prosper you, not to harm you. Plans to give you hope and a future.” Well, it says before that, “Here’s how you do that. You build a house, settle down. Plant a garden. Eat from your own garden. Marry. And have sons and daughters.” And he says, “Then pursue prosperity in the city where I’ve called you. Stop listening to deceivers. Then I’ll prosper you.” Well, prosperity was in our family, Jim.

Jim: Ah.

Chuck: And we flipped over and started to see that God said, “If you marry and have children, he will prosper you.” And so there was an apologetic for marriage. Young people today think if they live apart they can do better financially. All the data says no. In fact, people do better financially if they do get married than any other living arrangement.

Jim: Right.

Chuck: And so, we wanted to redefine what we believed prosperity was according to the scripture. And that changed my focus completely to being in the home instead of out of the home.

Jim: Right, and, again, you’ve covered one and two. Three, discovering life’s purpose, you’re touching on that as well. I think, in that regard.

Chuck: Well, we realized money was not our purpose. Uh, for me it had been. Making a lot of money is not your purpose in life-

Jim: What is?

Chuck: Money is a tool to support your purpose. Your purpose is to glorify God.

Jim: Yeah. That’s a great position. And, uh, you know, I hope people are absorbing that. We’re gonna, again, I apologize, we’re running through these. But get the book. (Laughs). I mean, that’s the- the- the main point here. Uh, number four, was God’s philosophy of money. Uh, quickly describe that.

Chuck: Well, Ann had a philosophy of money coming from her frugal background. I had a philosophy of money coming from a risk orientation. And we couldn’t agree. No way we could agree with each other. But we realized God has a philosophy of money. We decided to dedicate ourself to knowing what the Bible said about money, and that’s what brought us into unity.

Jim: Um, number five was respecting your spouse’s personality. You certainly have described that, how that evolved for the two of you. But I want to double down, (laughing) as a risk taker in marriage, Chuck. It’s really critical that we get to know our spouse as best as we can and to respect the differences, not attack the differences.

Chuck: Yeah, for sure.

Ann: Well we realized we- we were opposite in every possible way. But, that was good. When we realized that that could be an asset, that helped.

Chuck: Well, I put Ann in charge of paying the bills, Jim. She’s the detail person.

Jim: Yeah?

Chuck: In fact, there’s a Harvard study that says if one of the people in the marriage is picky, and detail oriented, you’ll do better financially. But put them in charge. Well, that’s Ann. She’s detail oriented. And, I started to bring her in and take advantage of how God wired her. We never are late on any bill now. When I was in charge, we were always late.

Jim: Right. That’s interesting. I mean, go with the strengths of the couple, right? Who- whoever does whatever best. Number six was create a unified financial plan. Um, what are the basic elements there?

Chuck: Well first of all, we decided to make giving our highest financial priority, Jim. We flipped over the idea of from, “How much could we accumulate? To how much could we give away in our lifetime?” And we have lived that out, which is totally contrary to the way that we used to think about money.

Ann: Mm-hmm. Well I felt like if you could trust God, then it would work. (Laughs). He would help us make it work.

Jim: And he did.

Ann: Mm-hmm.

Jim: Yeah, that’s good. All right. The final key to make marriage and finances work is establishing a process that ensures success. And I- I would imagine you’re starting from spiritual success-

Chuck: Yes.

Jim: … and then working down. One of the things you implemented was called red light/ green light. And I love this. And I think every couple should do this, because it’s so simple, but effective.

Chuck: Well, Ann, I’m gonna describe some it and I’d like you to describe a little bit of it. Maybe tell the story of how-

Jim: Oh we need examples (Laughs).

Ann: Okay.

Chuck: Well, just real quickly, what happened was when we were trying to make a financial decision, we set a threshold of $250 or more. If it involved a spending of $250 or greater, then we would both need to agree. Well, what ha- would happen, if Ann didn’t agree with me, then I would just debate her until she did.

Ann: (Laughs).

Chuck: And she just got so tired of that. So one day she said, “Look. Let’s use the stop lights. If I say red, then it’s no. We’re not gonna do it. If either one of us say red. If it’s yellow, we’re gonna wait and pray, and just trust the Lord. If we’re both green, then we’ll go ahead and do it.” And I said-

Jim: Yeah, very simple but very effective.

John: Hmm.

Jim: You know, again, the- these are all great things that we’ve talked about. And your honesty has been wonderful. E-e- especially your 20-year struggle to do better.

John: Mm-hmm.

Jim: I mean, what it we as Christian couples had that attitude about every area of our life? You know, “Lord, I’m giving this to you. Help my spouse.” And then that revelation that comes at some point. You being faithful in that prayer and then your spouse going, “Wow. I’ve just … you know the Lord just shared this with me (laughing) what do you think?” “Oh, I’ve been praying about that for 10 years.” (Laughs). But, in intimacy, in finances, in how we deal with in-laws, how we deal with friends as a couple, those are all the stressors and how- how we get along as couples can stress us out, rather than it being a thriving environment, which is what we want, uh, couples to have, it becomes contentious. And so many young couples today give up so early. And I’m thinking of that couple that’s in their late 20s or 30s and that wife is beginning to pray but she’s withering-

Ann: Hmm.

Jim: … like a- a flower that’s dying. And she’s not willing to stick with it til God answers that prayer. And my heart breaks, ’cause we get those phone calls every day. And our Hope Restored Marriage Intensive is filled with couples like that. This is the last hope they have. And I would just encourage you as a couple, if that’s where you’re at, contact us. I mean, this is a winsome way of how to get through financial difficulty. But there are some serious, uh, solutions here that Chuck and Ann have described in their book, Money Problems, Marriage Solutions: 7 Keys to Aligning Your Finances and Uniting Your Hearts. I would say that’s the Lord’s call for all of us as married couples, to unite our hearts and to behave in the ways that he would like us to behave. Thank you for being with us. Thank you for sharing the story.

John: Hmm.

Ann: Thank you for having us.

Chuck: Yeah, thank you, Jim. Thank you, John.

John: And we hope that you’ll follow up and get a copy of this great book, as Jim has said. Um, Money Problems, Marriage Solutions. We do have that. And when you get the book from Focus on the Family, you’re investing in our efforts to strengthen marriages, and, uh, to save babies and to help parents raise thriving kids. It’s all available at focusonthefamily.com/broadcast, or call 1-800, the letter A, and the word FAMILY. And, if you’re able to help Focus on the Family financially, we sure would appreciate that, either a monthly pledge, or one time gift. Um, if you can make a contribution today, we’ll send that book to you as our thank you for joining the support team. Once again, our number, 800, the letter A, and the word FAMILY. And on behalf of Jim Daly and the entire team, thanks for joining us today for Focus on the Family. I’m John Fuller inviting you back as we once again help you and your family thrive in Christ.