Opening:

Excerpt:

Dave Ramsey: So by 11 a.m. or whatever, the other kids are getting ice cream, the other kids are jumping on this ride, and this one’s standing by my side – “Daddy, can I have some money?” “No, I told you.” It was a long day. It was so long that it was 25 years ago and I remember it right now.

End of Excerpt

John Fuller: Dave Ramsey remembers all those years later about a time when he was trying to teach his own child how to handle money well. And he’s with us today on Focus on the Family to help you not have the bad memory, but have a good memory about your kids and their money. This is Focus on the Family. I’m John Fuller, and your host is Focus president and author Jim Daly.

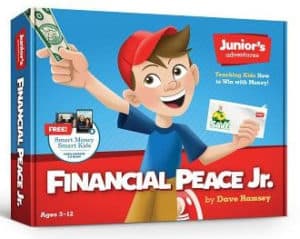

Jim Daly: John, last time we started a great conversation for all of us as parents about the process of training young children to handle money well. And of course, the Bible is full of ideas about this. It’s one of the most talked about subjects in scripture. For example: the rich rules over the poor and the borrower is slave to the lender – that’s right out of the Bible. The Bible always talks about contentment and how we use money for either power or for good. And Dave Ramsey has been teaching people how to handle their finances so they can save and give and honor God with their money. Today, he wants to help you teach your children how to do this through Financial Peace Jr., one of his resources.

John: Yeah, Dave is a best-selling author and a nationally known radio host. And he helps people manage their money wisely. The Dave Ramsey Show has been on the air more than 25 years. It’s heard by millions every week. And the resources that Dave has written, as you mentioned, Jim, Financial Peace Jr., is really the front and center piece for today’s conversation. You can learn more about that resource at focusonthefamily.com/broadcast, or call 800, the letter A, and the word FAMILY.

And by the way, if you missed our last program with Dave, we talked about parents who don’t have their own financial act together, and how kids are watching and learning from you about money. By the way, if you missed our last program with Dave, ask for a CD when you get in touch.

And now here’s day 2 of our conversation recorded with Dave Ramsey in his own studios in Nashville, Tennessee.

Body:

Jim: Dave, welcome back to Focus on the Family.

Dave: Well, we’re honored to be here. As we said last time, when my kids were being born, I was listening to Focus on the Family as a brand new Christian, just learning to love Jesus and learning how to be a daddy, uh, through the lens of scripture. And this program has carried our family forward.

Jim: You know, Dave, so many people that are in a hole, whether it’s a financial hole, a marriage hole, whatever it might be – you look back on those 25 years, look what the Lord has done with you and your family – your lives. This is amazing.

Dave: God is, uh, pretty much an expert at restoring messed up stuff. And, uh, that was me for sure. And, uh…

Jim: And I love that about your story you weren’t born an expert in finances.

(LAUGHTER)

Dave: Oh, I have a Ph.D. in D-U-M-B, that’s what I have.

(LAUGHTER)

No, I’ve done it all wrong. Uh, and, you know, I did it all wrong as a dad. I did it all wrong as a husband early on ‘cause I didn’t know what to do. I didn’t have that. And so I thank God for ministries like this that have spoken into my life over the years. And I’m often asked these days, ‘cause I’m getting old, you know, “What would you tell a young person?” I say, you know, content, baby. You got to put, you know, read books, jump on the radio, jump on these podcasts and – and get with people that know stuff you don’t know about what the word of God says. And, uh, it will cause restoration in your life. It will cause growth in your life. It will cause love to come out of your pores that you didn’t even know you had.

Jim: And I think the bigger word for that is wisdom. You gain wisdom when you do those things, and then apply it, right? That’s what you’ve been doing for so long now – helping people apply wisdom to their finances. Uh, Financial Peace Jr., teaching children. This is great. I mean, this is good stuff. We, uh, had a fun last time. Let’s pick up where we dropped off last time. You talked about spending. And, uh, that’s the fun part. But you mentioned right at the end of the broadcast last time about telling the kids, the younger kids particularly, just, you know, let ‘em blow their money. I could hear moms, particularly, goin’, “Is he crazy?” What did you mean by blowing a little bit of money and not being pharisaical about it as the parent?

Dave: I wanna allow them to make mistakes that bring them regret while the mistakes are small and under my wing.

Jim: Let them fail?

Dave: Let them fail – non-fatal failures, because they can learn a concept, they can learn, uh, with an ouchie moment on having spent money on something dumb, okay? Let them feel that when they’re 14 or 4, rather than when they’re 44, and it’s a new Porsche.

Jim: Do you think – let me ask you this because when I look at in the mail and the emails that we get at Focus, Christian parents want to do a good job. We want to honor the Lord. We want to do the right thing. We want to follow the rules…

Dave: Absolutely.

Jim: And then we want our kids to do that as well. We have a – I think, a problem allowing our kids to fail in little incremental ways.

Dave: I think the mistake we make, and we talked about this last time, is that we want our kids to behave. And if you’re not careful, you spend all your time trying to raise great kids. Don’t raise great kids. My friend Andy Andrews says, raise kids that become great adults. And that means they need critical thinking skills, and critical thinking skills involve having experienced non-fatal failure. There’s nothing like experience to bring wisdom. And you can control the level of pain with the experience. And so it’s not laissez-faire, I take my hands off the wheel and hope the kid can drive – that’s not what we’re doing. But if they’re gonna bump into something, I’d rather it be in the cornfield than on the interstate. And let’s get the Jeep out there in the cornfield and drive around and run into a fencepost, instead of hit somebody head on at 85. And so let’s learn how to drive in an environment where it’s non-fatal. Let’s learn how to handle money in an environment where it’s non-fatal. And I don’t care if my kids are perfect. My – what you think about my kids is irrelevant to me. My job as a dad is to raise kids that are becoming great adults. And if you don’t like the way I’m doing it, that’s your issue, not mine.

Jim: And that applies to moms too.

Dave: Yeah. The comparison game with our kids, and we turn them into Stepford kids – little Stepford Christian children – dee dee dee dee dee dee dee…

Jim: Exactly.

Dave: …Walking along, they’re little robots, and they don’t have the ability to think for themselves because they’ve been given such strict boundaries by their parents that they can’t behave. Now I’m not into anarchy, either. The inmates didn’t run the place, okay?

Jim: Right.

Dave: Daddy ran the place; there wasn’t any question about that at our place. But there’s boundaries, and within the boundaries, let’s have some non-fatal failure.

Jim: Yeah. Help that – that parent – describe some of those. I mean, driving, uh, the ATV – that might be one out in the cornfield. What are some other practical things that moms and dads can allow their kids, uh, to fail at? What did you do?

Dave: Well, I think it’s stuff with the money thing, like we were talking about earlier. The spending thing – I get misquoted so many times because someone’s hearing it from a real hardcore, uh, pharisaical, OCD – everything has to be perfect child – set of ears, or they’re hearing it from, oh, we just let our children do – we want them to enjoy everything. Let them be kids. Let them be kids, which translated – these are the people destroying the restaurant when I’m trying to eat, okay?

Jim: Right.

Dave: Because they don’t make their children behave. And so where we wanna land is somewhere in between. You know, too much grace is called enabling, and too many rules is called legalism. And so we want to land in the middle with the money piece, and allow them to make some little non-fatal failures – we had one go to the – we actually wrote a book about it called Careless at the Carnival – one of ours – we walked into the carnival, and they wanted to go do the games, and the games are all a rip-off. We know the carny games are rip-offs, right? You know, you’re not gonna win.

Jim: Are they?

(LAUGHTER)

Dave: You’re not gonna win.

John: News flash.

Dave: You can shoot the water in the clown’s mouth till the cows come home – you’re not getting the stuffed animal. It’s rigged, okay? We all know this as dads and moms, right? But the kid’s gotta learn. You know, Dad, I’m gonna do this. Dad, I’m gonna do this. Well, in two hours, she’d blown all her money.

Jim: But you let her go?

Dave: I let her blow it. And you know what she got to do the rest of the day? Nothing. Walk around and watch the other kids have fun.

John: Did she bother you about that?

Dave: Oh, all day long.

Jim: But you got to let that go.

Dave: It was a horrible day for her and for me. But, you know, I told you coming in, don’t do that. When you run out of money, you gonna be out of money. You’re not in Congress. You know, this is it.

(LAUGHTER)

When you’re out of money, you can’t print more. So you’re done. And, you know, so by 11 a.m. or whatever, the other kids are getting ice cream, the other kids are jumping on this ride, and this one’s standing by my side – “Daddy, can I have some money?” “No, I told you.” It was a long day. It was so long, that it was 25 years ago and I remember it right now. I’m reliving it.

(LAUGHTER)

Jim: I’m thinking, I mean, only in Dave Ramsey’s family would his daughter have to say, “Daddy, what – what’s Congress?”

(LAUGHTER)

Jim: I love it. Uh, but, Dave, that is so true, um. The other aspect of this is saving up money because that’s a difficult concept for adults, let alone kids. One of my boys did a great job. They wanted this big Lego – Star Wars Lego – and it was, like, 400 bucks. And I’m saying, “Daddy’s not paying for that.” So he saved, like, for 18 months allowance, little odd jobs, he was probably 9, 8 years old.

Dave: Wow! Good for him.

Jim: And he bought it. And, uh, man, that was a celebration. I told my wife, I said, “He’s got it. That’s a good attitude.” Now, there’s other problems that we experience as parents.

Dave: Always!

Jim: These kids are not perfect.

Dave: No!

Jim: And guess what, their parents aren’t perfect either – meaning us – but that’s kind of what you want to see in your kids, at least in that way.

Dave: Exactly. And what a great memory. Just like the carnival memory, the Lego memory is there. That’s a memory he will tell his kids about. It stuck in his psyche. It stuck in his spirit. That wisdom will never be un-learned ever. You cannot take that from him. That was a gift you gave him, teaching him self-control and delayed pleasure. That’s the power of using the money thing to create life lessons and character things as you go along.

Jim: Well, and that’s a wonderful point because what you’re doing with everything in the financial realm, it’s far deeper than money. And that’s why the Lord was pointing that out in Scripture, right? Our character, our attitude about how we use money, how we spend money, how we save money – it’s about our character, isn’t it?

Dave: It is. So as we talk about saving, you can say, well, one definition of maturity is learning to delay pleasure. And, you know, it says in Hebrews, no discipline seems pleasant at the time, but it yields a harvest of righteousness. And so if you live like no one else, later you get to live and give like no one else. And so you’re teaching delayed pleasure when you’re teaching savings. Now that’s age-appropriately – what’s delayed pleasure when you’re 3? – till the end of the week.

Jim: Or the end of the day.

Dave: Yeah, yeah, maybe. What’s a delayed pleasure when you’re 13? You’re saving for a car when you’re 16. It’s a different thing because they need to be able to see further into the future as they mature. And so, again, it’s age-appropriate, but when we were together last time, we set the table. There’s four things kids need to learn about money. They need learn to work, and that work creates money. They need to learn to spend wisely, which we’ve talked about. They need to learn to save. And they need learn to give. If you learn those four skills, if you’re 4 or 54, you can win with money. And by the way, every four – all four of those are supported by scripture. All four of them are. You know, there’s all kinds of scriptures about enjoying the things that God gave you. Your heavenly Father’s crazy about you. That’s the wise spending – having some enjoyment with money. And that’s not a prosperity gospel thing. That’s just – your Heavenly Father loves ya.

Jim: You don’t need to feel guilty.

Dave: You don’t need to feel guilty about enjoying the fruits of your labor – it’s in Ecclesiastes. You know, saving money in the house of the wise or stores of choice food and oil. Of course, giving money, there’s all kinds of – God loves a cheerful giver, and who’s more cheerful than a 4-year-old giving? They’re the most generous people on the planet.

Jim: Give it all away.

Dave: Exactly. And, of course, you know, so work. There’s all kinds of scripture about working. And, um, you know, those of us that are real tough, we bring all those scriptures, you know, you don’t work, you don’t eat, you know, or I’ll break your plate. You know, that kind of stuff.

John: Which Bible verse is that?

(LAUGHTER)

Jim: The one next to, uh, godliness – cleanliness and godliness.

John: Something like that. Well, Dave Ramsey is on today’s Focus on the Family, and the great wisdom he’s sharing is, indeed, found in Scripture. He’s done a great job of pulling it together and making it accessible for parents, and grandparents, I might add, in a wonderful kit called, Financial Peace Jr., and it’s got stuff you can put on the fridge, charts you can use, things you can talk through with your children at different ages and great guidelines for helping your kids get these four main areas of finance. And along the way, hopefully, you’ll learn a bit, too. Give us a call and we’ll tell you more: 800, the letter A, and the word FAMILY – 800-232-6459.

Jim: Dave, I want to go more into the giving side. That’s an important aspect of our Christian character. With all of the people that you have counseled, what is one of the stories that remains stuck in your head that was so amazing about a person who learned to give?

Dave: You know, we’ve all heard the stories – and I’ve heard thousands of them – of someone who first meets God and God says, test me on this, regarding the tithe in Malachi. And they start tithing, and the number of times they are honestly surprised that they don’t, (a) they don’t miss it, and (b) God – especially when you’re young in your faith, I think God will put something equivalent to the tithe in your mailbox.

Jim: Hm.

Dave: The number of times I’ve heard those stories – weird. Now again, it’s not a guarantee. Sometimes it’s just God winking at you and just going, “Kid, I gotcha. I gotcha. I’m holding you. This is not – you’re going to be okay.” And He says, “Test Me.” It’s one of the few times in Scripture He says to test Him. And you don’t want to do that much, you know? But there’s one time there He says give it a shot, in other words.

Jim: Come on.

Dave: And let’s see how 90 days from now – and I challenge people all the time. I said, you know, start tithing. Start giving a tenth of your income and after a year, sit down and ask yourself what really happened.

Jim: Yeah.

Dave: And if it didn’t work out for you, if you don’t feel a change in your family, you don’t feel a change in your character, you don’t feel a change in everything else then, you know, you can go back and you can just stop doing it. But, you know, test. Run a test. See how it works.

Jim: What do you think is happening in the human spirit when we get to the point where we can give joyfully? What’s going on in our hearts when we can do that well?

Dave: Well, there are several things going on in our spiritual walk. Number one, it’s a Lordship issue. And I don’t mean that as a doctrinal, funky thing. I mean, it’s just who’s in charge.

Jim: Right.

Dave: And so when we were teaching our kids to give, we’re teaching them all the money that we’re laying out here in front of you – the money going in the saving envelope, the money going in the spending envelope and the money going in the giving envelope, none of it’s yours.

Jim: Hah.

Dave: You don’t own it.

John: That’s a good reminder.

Dave: As for me and my house, we serve the Lord.

Jim: So it’s a stewardship?

Dave: And you’re in my house.

Jim: Yep.

Dave: So you’re managing that savings for His glory. Your spending needs to reflect His glory, and your giving, it’s not even yours anyway so it shouldn’t be hard to give it.

Jim: Yeah, that’s good.

Dave: And just change that. And you start doing that at 4, by the time they’re 34 they’re outrageously generous, way beyond a tithe.

Jim: And it’s a lot about attitude.

Dave: Because they understand they don’t own it.

Jim: Right.

Dave: If you don’t own something, it’s easier to give it away.

Jim: That is really good. Let – let’s be practical. I mean, when you’re looking at that 3 to 5, what are some of those practical giving opportunities for a 3 to 5 year old?

Dave: The biggest problem you’re going to have is they want to give it all away.

(LAUGHTER)

Jim: So how do you tell them don’t give it all away? That’s…

Dave: I told them it’s not wise.

Jim: Yeah.

Dave: It’s not God’s plan. God says in the house of the wise are stores of choice food and oil. Which means wise people don’t give it all away. The number of times God tells you to give 100 percent of your assets away is very, very low.

Jim: Mmhmm.

Dave: I’m not saying it can’t be done. I’m not saying the Holy Spirit doesn’t direct some people to do that, but it’s not normative in Scripture. It’s not the normal Christian walk, especially Evangelical Christian in North America. Okay? But always be giving something because the rhythm of giving in your life, the consistent rhythm of giving, is your reminder of who owns it. It’s your reminder of this Lordship issue. It’s a reminder of “Hey, even my spending envelope is not mine. So am I bringing glory to the Lord by buying Celebration Barbie?” And you can talk to an 8-year-old about that. And actually, I think that is giving glory to the Lord, by the way. I think you should celebrate. And I think God wants you to celebrate.

Jim: Right.

Dave: David danced a lot.

Jim: Yeah, he did.

Dave: You know? And I think Celebration Barbie – and if you don’t have a lot of money, you can get sorta-kinda-how-to-party Barbie, you know? But…

(LAUGHTER)

Jim: Yeah, I love it. You’ve had daughters. I have not.

John: Yeah, you’re not connecting with Jim and boys…

Jim: Let’s talk footballs.

(LAUGHTER)

Dave: Same thing. You know, it’s a larger or smaller football. But the whole thing about giving is so many times in church, we’re walking across the church parking lot towards the building, and we hand our child some money out of our pockets so he can or she can drop some money in the – in the offering at children’s church or in children’s Sunday School. They’re not a giver. They’re a courier of your money. No transfer of blessing occurred there. No lesson was taught there. All they did was deliver something for you.

Jim: Mmhmm.

Dave: They didn’t earn some money doing their chores and then in turn give that money. When they do that – that’s when God smiles.

Jim: And they’re connected?

Dave: Because you’re turning them into givers, and God’s the ultimate giver. He gave His only son.

Jim: That is so important to remember that. You’ve got to – they’ve got to feel it, not just be the courier. That is good.

John: Is there a time, Dave, when you want to make a child give?

Dave: Yes.

John: Okay. What does that look like?

Dave: I’m going to make them do all four of these things if they won’t voluntarily do it.

John: Okay. So my 10-year-old…

Dave: Again, I’ll let them have a little slack.

John: Yeah.

Dave: Little bit of slop in there. Everything’s not perfect, and I’m not – we’re not trying to create Christian Stepford children, right? But over the course of time, it’s my job as your dad, as your mom to make you learn to work, to learn to give, to learn to save – these are – and to learn to spend wisely. These are skills you need to be successful. They’re biblical skills that God said you need. And they’re wisdom skills. And it’s just like brushing your teeth. I have to teach you to do that or you won’t have any.

Jim: Dave, what about introducing your kids to poverty? I mean, especially if you’re in the suburbs, you’re growing up in middle-class America. How – how far should we go to let them see it and let them participate in giving in that direction? Should we take them to the soup kitchen? And what are your thoughts on that?

Dave: I think our kids will tell you that changed their life more than anything we’re talking about in these two episodes.

Jim: Hmm.

Dave: Two things – one is you find folks in the community around Christmastime, Angel Tree or something like that. And, you know, we would go in and do – you know, buy Christmas presents for the family. And yeah, we’re probably going to go down, take some turkeys on Thanksgiving Day to the homeless shelter and just hang out down there and actually get to sit and talk to a guy that’s homeless and find out how that happened and…

Jim: Here’s life.

Dave: …Kind of learn that lesson. And…

Jim: Yeah.

Dave: …You know, when you’re eight years old, you’re not creeped out by that stuff. You kind of – it’s kind of cool. You want to know about it.

Jim: Right.

Dave: And the best thing – I mean, a teenage mission trip – I mean, our kids going to Haiti, our kids going to Peru – you know, they think they’re going down there to help somebody. They probably didn’t help them that much, honestly. But they probably just interrupted their lives. But they come back…

Jim: Changed.

Dave: …Completely changed because they grow up in a bubble.

Jim: Yeah.

Dave: If they’re in North America, I don’t care what neighborhood you’re in. You’re in a bubble.

Jim: I think the point of this is it’s all connected, again. We look at finances as a bank transaction. But this is a deeply spiritual matter. And that’s what your whole program’s about, isn’t it?

Dave: Well, it is. And then you get the benefit of one of them looking up. And he’s saved some serious bank. And he’s 18. And he goes, “Dad, you know, there was just a hurricane hit down there where we were. And I think God’s telling me give $10,000 to that.” He’s 18.

Jim: Wow.

Dave: And, you know, tears just start coming down your face. And you’re going, “Wow, this parenting thing’s cool.”

Jim: Well, and pat yourself on the back, seriously. I mean, that’s an achievement when you have built into your children in that way. I don’t want to end today without talking about credit. That’s something that you’re hilarious about, you know, in terms of the barbecuing. But is there a role, especially for your teens, to allow them a minimal credit card so they can begin to learn about the use? Or do you say don’t even do it? Just teach them how to use cash.

Dave: Well, from an adult or a children’s perspective, I didn’t grow up in church. I didn’t grow up in Scripture. So when I got saved, it was radical. And I had to decide that that the whole of scripture is real or it’s not. And that’s a Lordship issue for me. If I can find it in the Bible, I’m good with it. But I can’t find it? I’m not good with it. And I’ve studied this for 30 years, this money stuff in Scripture. I can’t find one single, positive reference to debt in Scripture.

Jim: Huh.

Dave: It’s not there. It’s not a sin. It’s definitely not a salvation issue. I mean, you’re not going to hell for a MasterCard. That’s not it.

Jim: Right.

Dave: Okay, that’s not what we’re saying. But they did call it “Master”Card.

Jim: Ha, that’s interesting.

John: I hadn’t thought about that!

Dave: I mean, think about it. There’s a hint in there. But, uh…

(LAUGHTER)

But, you know, this idea that – that – that the bank is my provider instead of the Lord as my provider has changed our culture. And we’ve watered it down in evangelical Christianity, in particular. And we said well, “You know, Dave Ramsey’s crazy.” Dave Ramsey may be crazy. But I hadn’t had a credit card in 30 years. I don’t borrow money for anything ever. And I taught my kids the same thing.

Jim: Yeah.

Dave: I did teach them to manage money and save money and handle money. And if you need something, save up. So they had debit cards to do transactions with and a checking account when they were 15. We put them on that. And they would manage even their own clothing budget. We put – we’re their parents. We buy their clothing. But the way we bought it was we put the money in their account and they made the purchases. And that taught them to even manage a larger budget. And it taught them to handle a debit card, handle a checking account. And one of their chores that they get paid for then is to keep that checking account balanced and not going to overdraft.

Jim: Huh.

Dave: And can you imagine being Dave Ramsey’s kid and bouncing a check?

(LAUGHTER)

Dave: It happened.

Jim: Once.

Dave: Once, once, and she will never – has never bounced a check since because I made her go to the bank and apologize for lying.

Jim: Huh.

Dave: And that’s what an overdraft is.

Jim: Yeah.

Dave: You lied. You may have lied by disorganization and sloppiness. Or you may have directly, straight-up lied, just stole some money there for a few minutes. I just feel entitled to some money that I don’t have. That’s what a thief is. And that’s pretty hardcore.

Jim: That’s amazing, when you think about it in that context.

Dave: But you know what? But you know what? They don’t borrow money.

John: And how old was she at that time?

Dave: Ah, she was 15, almost 16, and, uh, not old enough to drive herself. Her mom had to drive her down to do the apology. But, uh, she’ll tell you this story. It marked her.

Jim: Yeah.

Dave: She’s still in counseling for it.

(LAUGHTER)

Jim: But in a good way.

(LAUGHTER)

Dave: But, you know, that’s the thing. So I feel that way about debt. I – I’m gonna give them all the tools to win in the culture. A debit card will do everything a credit card will do except get you into debt. And you don’t need that. Um, you don’t – if you’re going to take out a mortgage, um, it’s the one thing I don’t yell at you about, but I can’t even prove to you in Scripture that’s okay.

Jim: Huh.

Dave: I’m not gonna yell at you about it, but I want you to pay that off as fast as you can. And you can get a mortgage with no credit score. All you have to do is pay your bills on time, have a job, and have a good down payment. And you gotta go prove that. That’s all. Pay your bills, meaning your utilities and that kind of stuff. You can do manual underwriting. So this idea that I’m going to teach my child how to properly handle a credit card – that’s like, “Hey, here’s a rattlesnake. Properly handle this.”

Jim: That’s a great point, an excellent point. Dave, this has been so good. I’m supercharged to get back in – in a more aggressive way with my own teenage boys.

(LAUGHTER)

And, uh, they are saying, “Dave Ramsey, why’d you tell my dad all this stuff?”

(LAUGHTER)

Dave: I’m a – I’m a cuss word to several teenagers, I’ll just tell ya.

Jim: But I love it. And this is the real stuff. And I so appreciate the dedication of your life in this area – and the thousands – if not hundreds of thousands – of people that you have helped, kids that you have helped through their parents, applying these wonderful principles from Financial Peace Jr. Again, Dave, thanks so much for being with us on Focus. Bless you.

Dave: Thank you. We are honored. It’s been our treat.

Closing:

John: Well what a great conversation we enjoyed with Dave Ramsey in his studio and it’s been a privilege to share that with you on Focus on the Family these past couple of days.

Jim: And you know, we hope that you’ve been inspired – that’s our goal, to inspire you to teach and equip your children about the principles that Dave has shared. I mean, they are rooted in scripture too, that’s what I love about Dave Ramsey. He can walk in both worlds and do it very effectively.

We have a goal here at Focus on the Family this year and that is to get more friends like you to become a monthly supporter of Focus. When you commit to donating on a regular basis, you really take some of the pressure off of the budgeting cycle here. You allow us to syndicate this broadcast and record it – all of that costs money. And you know what, a lot of people don’t realize this, John, there are over 6 million listeners every week here in the U.S. and another 131 million listening weekly around the world. Providing this broadcast free of charge to others who need it costs us money and I am so grateful to those of you who support the ministry and stand in that gap. The Lord sees that! I know you’re working hard vocationally and you send a bit of that our way and I hope you can be proud of that seed that’s planted and what’s watered and the harvest that comes through a saved marriage, a baby’s life being saved, maybe helping that parent in distress. All those things work for the kingdom of God and you are key to it, not passive.

So, if you listen regularly but have never considered being a monthly supporter, can I ask you to join our team in that way today? And if you make a monthly pledge of any amount, we’ll send you Financial Peace Jr. as our way of saying thank you. This is a wonderful resource from Dave Ramsey to teach your kids about finances and I know because I’m using it.

John: It really is a great resource and we’re looking forward to sending it to you. If you’re not able to make a monthly pledge, we can still send that kit to you if you can make a one-time gift of any amount. Our number is 800, the letter A, and the word FAMILY, or go online and donate at focusonthefamily.com/broadcast.

And while you’re at the website, get a CD or download of this conversation, and make sure you download our free resource about avoiding the chore wars that are so common in families. You’ll learn how to balance household responsibilities when you get that download.

Coming up next time on Focus on the Family, how to be more intentional about loving your spouse every day.

Teaser:

Deb DeArmond: And he looked over the top of the coverlet and said to me very intentionally, Jim, “Babe, I choose you today.” And I said, “Great. What am I being chosen for?” He said, “I just choose you.”

End of Teaser